Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Business Value Acceleration

Most property investors would be somewhat familiar with the 3 Sacred D’s of Real Estate, which relates to three life events creating a “highly motivated vendor” scenario: Death, Debt and Divorce.

Deceased Estates are prime targets, as the primary decision-maker is usually an independent trustee or attorney who has little if any, emotional attachment to the property, or surviving family members seeking to distribute the estate quickly and equitably.

Debt defaults create mortgagee-in-possession sales, which also attract savvy buyers as the mortgagee is not necessarily looking to achieve the best possible price outcome, but merely enough to repay the principal.

Finally, divorces often create distressing atmospheres where the disputing parties can be looking to just put the immediate past life behind them as fast as possible.

The first 3 D’s apply equally to businesses but can have more devastating effects. The death of an owner or significant shareholder can deprive an enterprise of one of its key drivers or set in motion a chain of unintended negotiations between their estate and the surviving partners over the shareholding.

Divorces – particularly when the soon-to-be ex-spouses work together – have the potential to destroy value within a company as a result of the inherent costs, emotional consequences and distractions arising, whilst unmanageable debt can cripple a business and not only destroy shareholder value, but also the lives of other stakeholders, including staff.

However, value-destroying distressed business situations also arise out of other distractions, which come in a variety of forms not restricted to the fundamental “3 Ds”, which can be expanded to number six in the business environment.

Distraction can manifest in new business ideas, outside interests, personal circumstances or plain old boredom, which can cause a business’ owner to take their eye off the ball and leave a company adrift.

Another of the 6 D’s that can leave a company adrift is disease (including disability). Ill-health can strike at any time and can be detrimental to a business. The loss of a key person for any period of time is difficult to cover in a smaller enterprise, and where death is a permanent condition, ill-health is in many cases only temporary, yet the timing and capability around return to work are rarely known from the outset, so is more difficult to plan for.

The sixth D relates to Disputes, which can occur in myriad aspects of business life. Disagreements with business partners, employees, suppliers, customers, landlords, and regulators occur on a regular basis and like the other D’s, can emerge completely out of the blue. The reallocation of resources required to deal with disputes often has adverse consequences for the business, particularly when costly third party professional assistance (e.g. lawyers, accountants, other specialists) is required.

Virtually all businesses are at risk of encountering the 6 D’s, but unlike with real estate, the prospect of simply selling the asset to mitigate the situation is either untenable or unachievable. Bricks and mortar are comparatively easy: there are no employees, goodwill or other stakeholders to consider, and any buyer will do as long as the cheque clears.

Business sale transactions require extensive due diligence on the part of the buyer, and distressed situations caused by the 6 D’s can quickly erode existing goodwill and potential market value, leaving the vendors in an extremely weak negotiating position.

Whilst none of the 6 Ds are particularly palatable conversation starters when it comes to long-range planning, a business’ sustainability may rely heavily on how well such situations have been planned for. So do include these considerations in your next planning session and think carefully how best to protect stakeholder value in the event that one or more of these potentially disastrous scenarios arise (e.g. perhaps in a SWOT analysis, include the 6 Ds in the assessment of weaknesses and threats).

Succession Plus

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

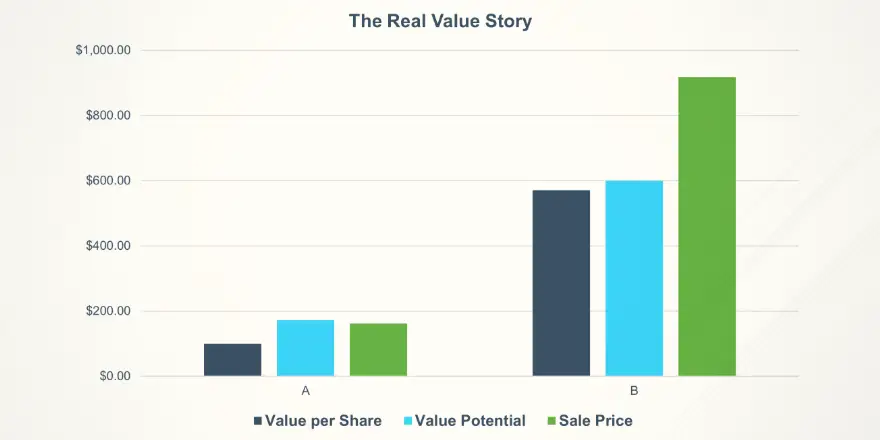

Unlock Your Business’s True Value Potential

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

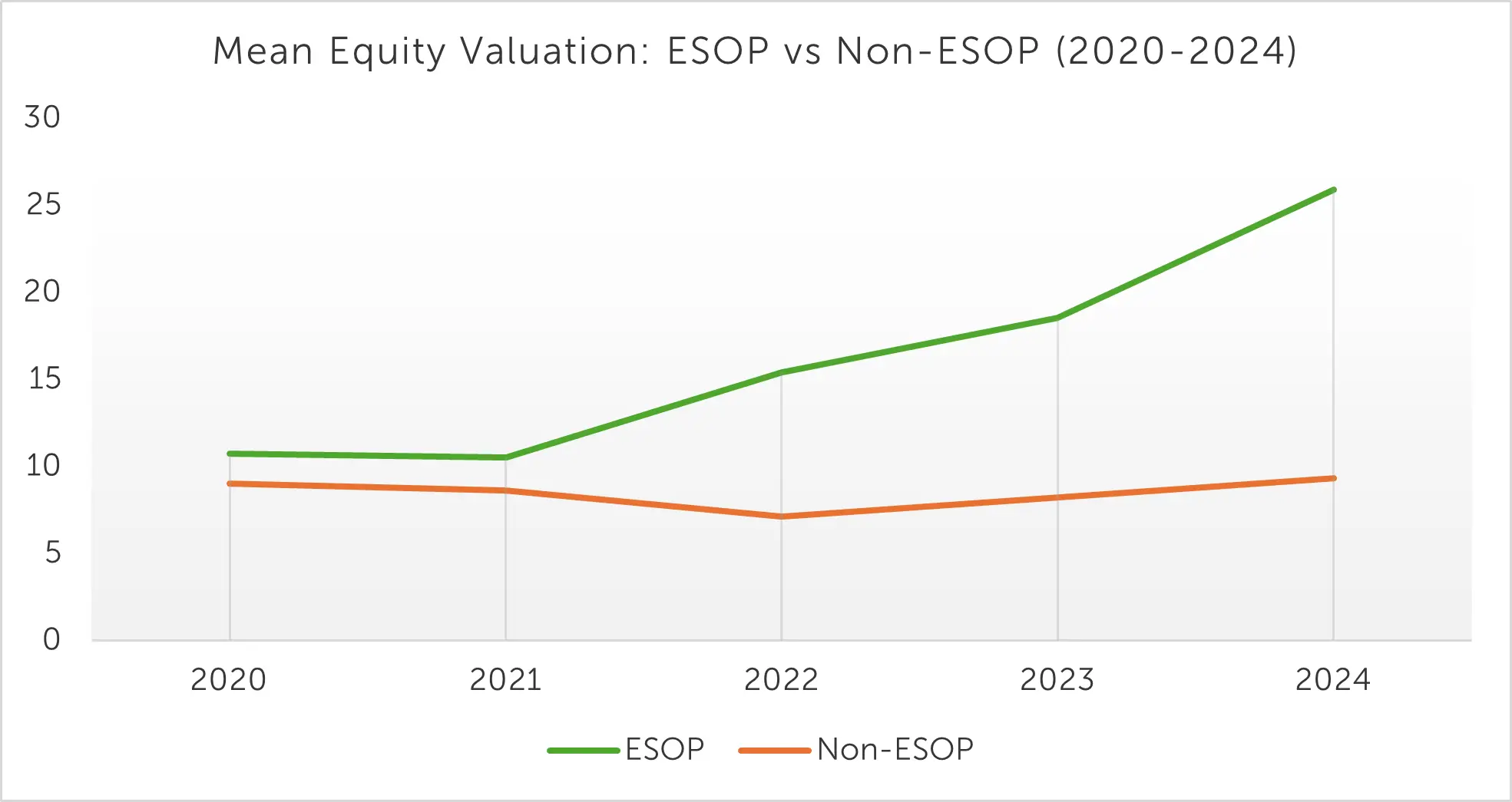

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

3 min read

3 min read

Oct 8, 2025 | Business Value Acceleration

Preparation Drives Premium | Strategy to Sale Results