Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Business Value Acceleration

A cash flow statement is a crucial financial statement that provides a summary of the inflows and outflows of cash within a business. It is typically divided into three key areas, namely Operating Cash Flow, Investing Cash Flow, and Financing Cash Flow.

Each section should net off inflows and outflows to show the generation or application of cash in the key segments. The cash flow statement should reconcile with the business bank account at the end of each month. The P&L via accruals (income statement) and the Balance Sheet carry the differences in timing between costs incurred and cash payments (P&L) as well as the store of asset value (Balance Sheet). Asset usage via depreciation charges then flows through to the P&L.

In conclusion, the cash flow statement is a vital component of a business’s financial reporting as it provides insight into the cash position of the business and helps identify any potential issues that may arise in the future. It is essential to provide a detailed statement that is tailored to the nature of each business, in order to facilitate issue identification.

The Cash Flow Statement enables forecasting of free cash flow that can be distributed to shareholders via dividends and/or capital returns. It also helps owners assess the possibility of leveraging the business to generate free cash for distributions, provided that there is sufficient debt servicing capability. The decision regarding the structure and form of the debt facility will depend on the strength of the operating cash flow. The risk assessment and the decision of the structure of the debt facility most suitable for the business will depend on the duration of asset lives, reliability of contracted cash flow, and level of robustness.

Succession Plus

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

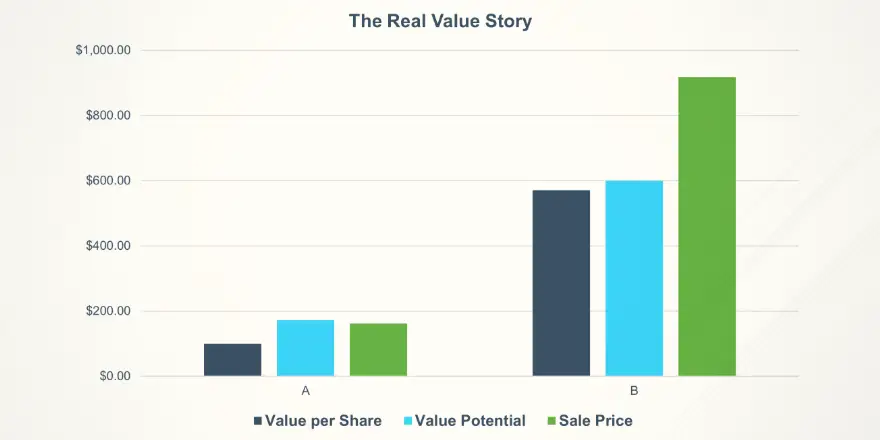

Unlock Your Business’s True Value Potential

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

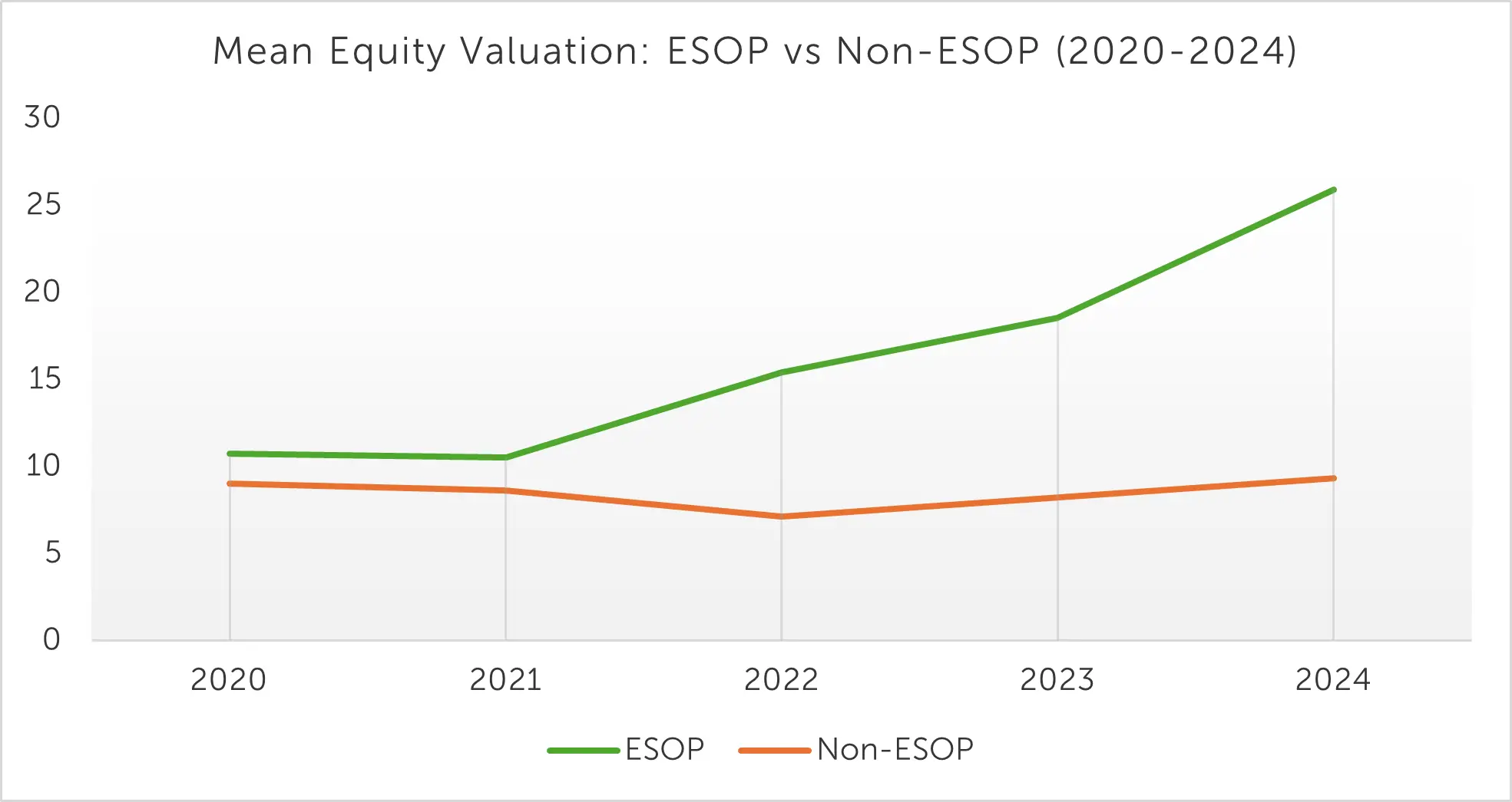

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

3 min read

3 min read

Oct 8, 2025 | Business Value Acceleration

Preparation Drives Premium | Strategy to Sale Results