Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Business Value Acceleration

The latest research on business valuation multiples highlights several key insights:

In summary, while valuation multiples such as profit, (we normally use NOPAT – check out why here) or in some industries revenue, are widely used and provide a quick way to assess company value, recent research advises caution. It’s important to understand the underlying assumptions and potential biases that can arise from an uncritical application of these multiples. Analysts are encouraged to complement multiples with a thorough analysis of a company’s fundamentals to achieve a more accurate valuation.

Our Capitaliz software analyses nearly 100 non-financial metrics as part of the algorithm to determine the valuation – these lead to an assessment of growth, risk, predicted cash flow performance and ultimately the likelihood of future returns. These metrics are accompanied by detailed analysis of industry benchmarks, used to identify over and under-performance, as well as industry trends and related risk. This then allows us to remove some of the bias and create a reliable valuation model for any business in any industry. This model is used in eight countries around the world and is becoming the benchmark standard for business valuation.

Dr Craig West

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

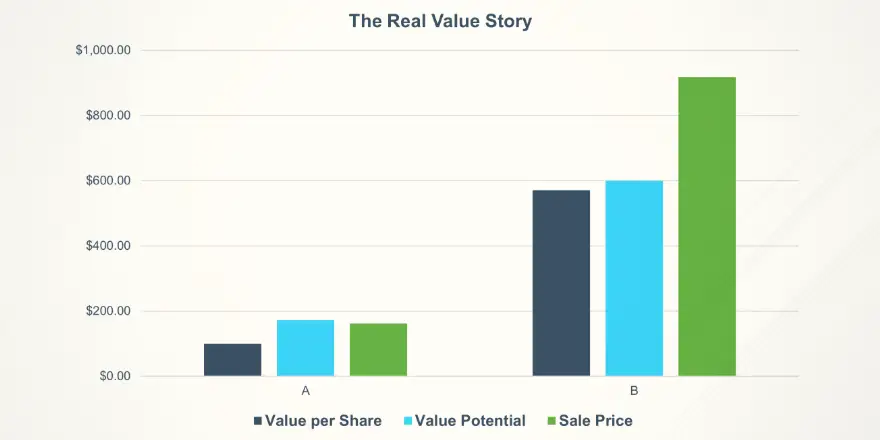

Unlock Your Business’s True Value Potential

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

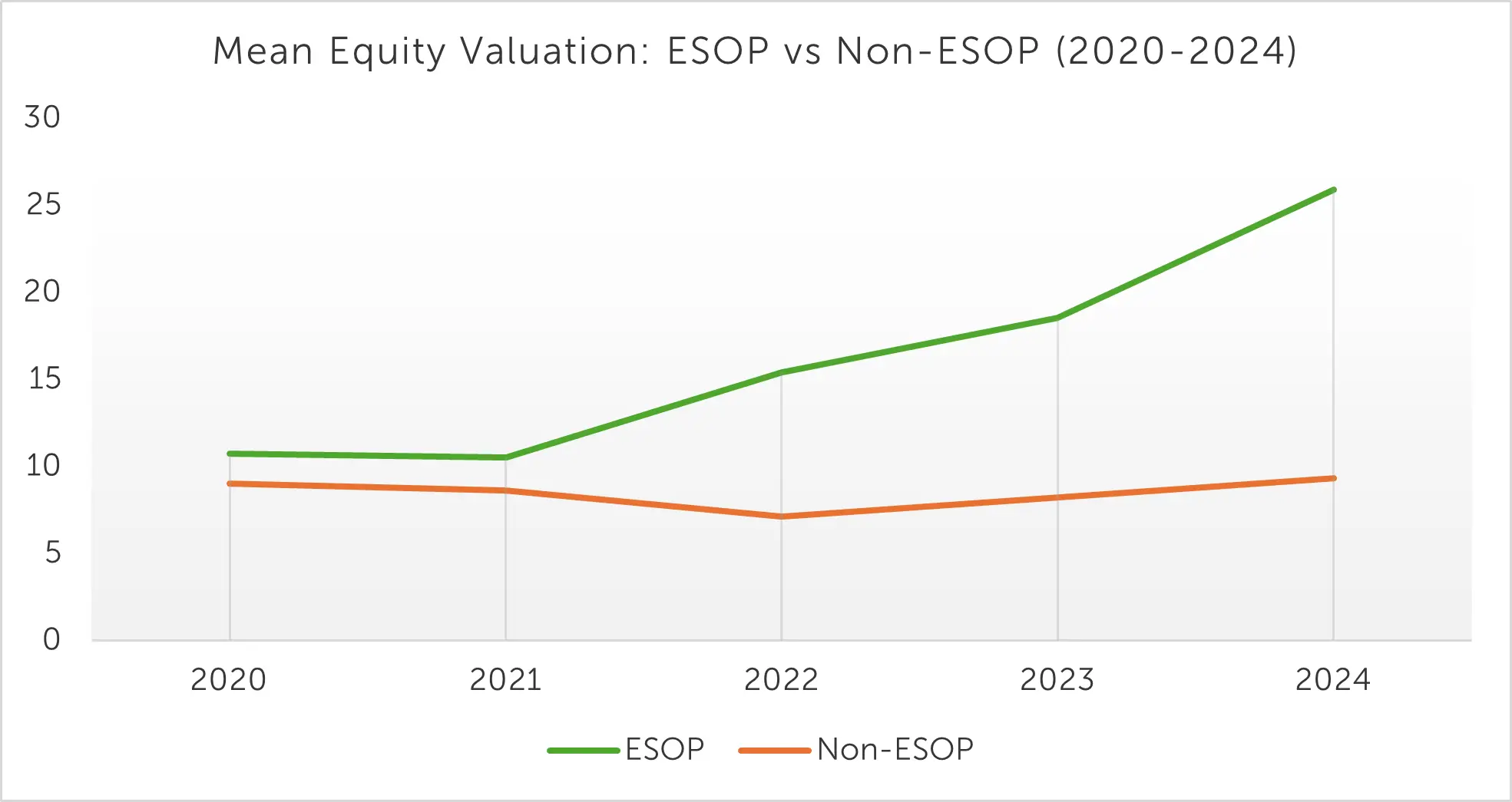

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

3 min read

3 min read

Oct 8, 2025 | Business Value Acceleration

Preparation Drives Premium | Strategy to Sale Results