Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Business Value Acceleration

A ‘significant’ business is one that is valuable, transferable, ready, and attractive at any point. Employing The Value Acceleration Methodology™ aligns the business owner’s personal, financial, and business goals with a strategic framework designed to drive value and unlock wealth, creating a harmonious roadmap to significance.

The Value Acceleration Methodology™ is a strategic framework designed to maximise a company’s value through a series of actionable steps. It emphasises the importance of aligning business, personal, and financial goals to create a cohesive plan that increases the company’s worth and prepares it for a successful transition — whether that’s a sale, succession, or other exit strategy.

The methodology is particularly effective because it takes a holistic view of the business, considering the financial metrics and the non-financial aspects that contribute to the company’s overall attractiveness and readiness for transition.

The concept of the “three legs of the stool” is a metaphor that encapsulates the holistic approach to exit planning and value creation. It represents the three critical components that must be balanced for a successful transition: the business, personal, and financial aspects. Below is a summary explaining the significance of each ‘leg’:

The first leg of the stool is the business itself. It’s about ensuring the company is operating at its peak, with strong value drivers, a solid market position, and a clear competitive edge. The Business Leg focuses on the strategies and actions that can be taken to enhance the business’s overall value, making it more attractive to potential buyers or successors. It’s not just about the numbers; the quality of the operations, the brand, and the company’s reputation in the market.

The second leg involves the business owner’s personal readiness. It’s crucial to consider what life will look like after the exit. This includes preparing for the emotional aspects of leaving the business and planning how the owner will spend their time. Whether you plan to pursue hobbies, engage in philanthropy, or start a new venture, the Person Leg ensures that the owner’s identity and fulfilment continue beyond the business.

The third leg involves financial planning that goes hand-in-hand with the exit strategy. It’s about ensuring that the financial gains from the business transition align with the owner’s personal financial goals. The Financial Leg involves wealth management, estate planning, and tax strategies to preserve and grow the wealth generated from the business sale or succession.

The stool’s three legs must be balanced for a stable and successful transition. If one leg is shorter or weaker than the others, the stool—and thus the exit plan—becomes unstable.

Succession Plus’s approach ensures that each leg is given equal attention, integrating business strategies with personal aspirations and financial planning. This balanced approach leads to a significant exit, where the business owner can confidently move forward, knowing they have left a lasting legacy and secured their financial future.

This metaphor of balancing the stool illustrates the interconnectedness of the various aspects of exit planning. It emphasises the importance of a well-rounded strategy for achieving a significant and fulfilling transition from business ownership, which many business owners never realise without it.

In pursuing business excellence, the transition from a successful company to a significant one is a journey of strategic growth and alignment.

Succession Plus’s 5 Stages of Value approach uses a strategic framework to provide a structured pathway for business owners to enhance their company’s value through a value management system, ensuring it is valuable, transferable, ready, and attractive at any point. We work to align the business owner’s personal, financial, and business goals within a harmonious roadmap to significance, integrating the owner’s objectives with the strategic growth of the business.

The first stage is about understanding the business’s value drivers, including identifying intangible assets. The process involves a deep dive into the company’s operations, market position, competitive edge, and the importance of intangible assets in determining a company’s fair market value. By identifying these value drivers, business owners can focus on what will make their company more valuable and attractive to potential successors or buyers.

Once the value drivers are identified, the next step is to protect them. This stage focuses on mitigating risks and safeguarding the business’s core assets. It’s about creating a resilient foundation to withstand market fluctuations and other challenges.

With a solid foundation, the third stage is about building upon it through a good business strategy. This involves strategic planning and execution to enhance the company’s performance, market presence, and profitability. It’s a proactive phase where significant growth is pursued through innovation and optimisation, aligning with the owner’s business, personal, and financial needs to grow value and expand options for the owner’s transition.

The fourth stage is the culmination of the efforts to identify, protect, and build value. It’s about reaping the rewards of the hard work and strategic planning. This stage involves considering various exit or succession options, making an exit plan crucial in preparing for the ‘harvest’ value stage.

Preparing the business for a smooth transition requires a comprehensive understanding of exit options. These options are essential for maximising the business’s value, ensuring a smooth transition to new ownership or management, and achieving personal and financial goals.

The final stage involves managing the harvested value. It involves ensuring that the wealth generated from the business transition is preserved and aligned with the owner’s personal and financial goals. It’s a stage of reflection and forward planning where the business’s legacy is secured for the future.

The 2023 National State of Owner Readiness Report highlights several key findings regarding business owners’ preparedness for exit. Here are some of the significant insights:

There has been a substantial increase in business owners’ education and awareness of exit planning.

In 2023, 70% of business owners reported being aware of all their exit options, compared to only 34% in 2013. This improvement is attributed to intentional efforts in education and a better understanding of the importance of exit planning. The use of the value acceleration process has increased in exit planning, and this is just a good business strategy; more business owners realise the need to build an exit plan that incorporates the value acceleration process.

These findings suggest a positive trend towards improved preparedness among business owners for their eventual exit, driven by increased education, awareness, and proactive planning. The report underscores the importance of aligning business, personal, and financial goals to ensure a successful and significant transition.

The Succession Plus 5 Stages of Value Approach is not just a methodology; it’s a philosophy that empowers business owners to elevate their companies from mere success to enduring significance.

Talk with Succession Plus about executing exit planning within the strategic framework of The Value Acceleration Methodology™, which integrates the owner’s personal and financial objectives, ensuring a legacy of significance that reflects the owner’s vision and values. Together, we can focus on building a business with characteristics that drive value but also provide many options to exit on the owner’s timeline and terms.

Ultimately, it’s what we do today that will help protect the legacy of positive impact you’ve built, safeguard your financial well-being, and ensure your business will continue to thrive long into the future.

Dr Craig West

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

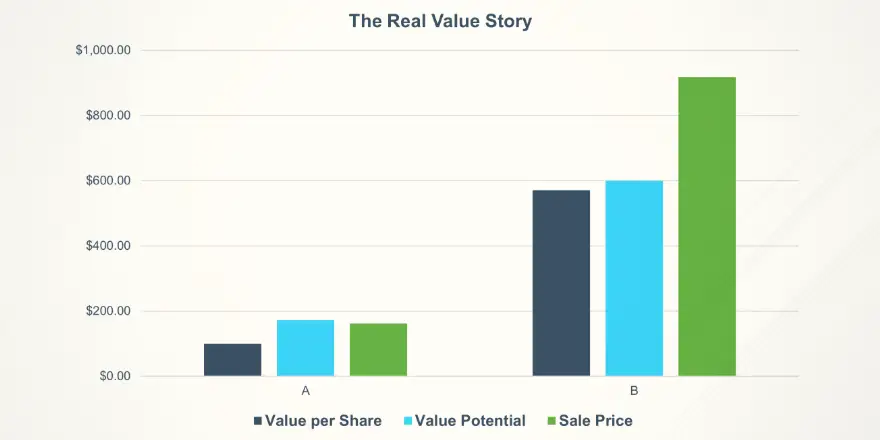

Unlock Your Business’s True Value Potential

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

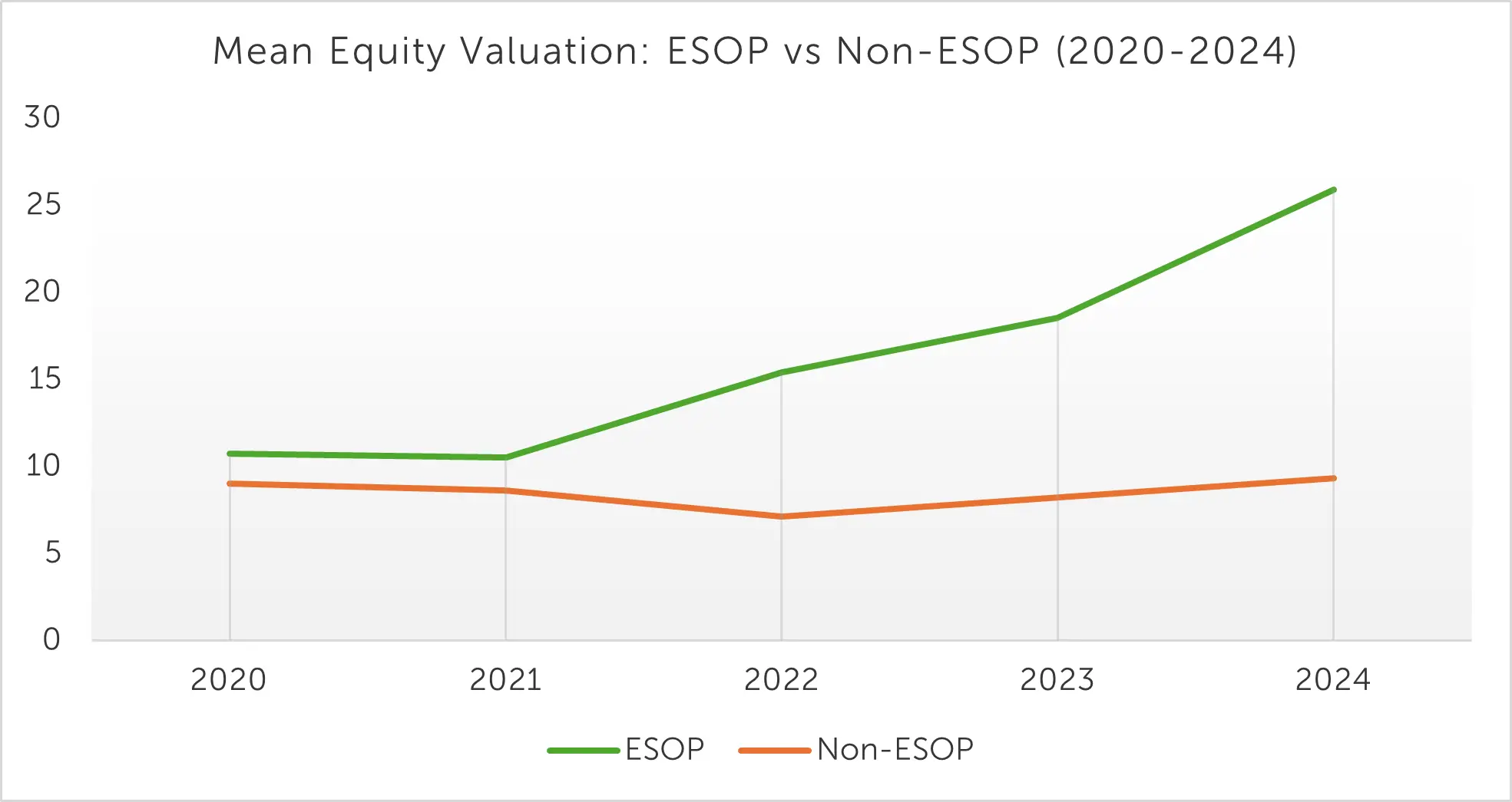

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

3 min read

3 min read

Oct 8, 2025 | Business Value Acceleration

Preparation Drives Premium | Strategy to Sale Results