Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

In this article, we will cover:

Succession Plus created its first Employee Share Trust for an LJ Hooker office in NSW in 2006, the first in Australia and still going strong. In the nearly two decades since, our advisers have rolled out more than 130 employee ownership plans – and associated trusts – for businesses of all sizes.

The two most common trusts are an Employee Share Trust (EST) and a Peak Performance Trust (PPT). A PPT is a specific type of Employee Ownership Trust (EOT), a mechanism used in Australia to facilitate employee ownership and participation in a company.

Ninety-nine percent of Succession Plus Employee Share Schemes are set up under a trust, and of those, 99% are a Peak Performance Trust.

A trust is a legal structure that allows individuals and businesses to transfer assets (such as property, money, or, in the case of an Employee Share Ownership Plan, shares) to a trustee.

The trustee, either an individual or a corporate entity, is responsible for managing and safeguarding these assets on behalf of beneficiaries. The trust’s terms and conditions are outlined in a legal document called the trust deed.

Trusts serve a multitude of purposes, including estate planning, asset protection, and a mechanism to ensure the orderly distribution of assets. In some cases, they can allow individuals to take advantage of certain tax benefits.

An Employee Share Ownership Plan, sometimes called an Employee Share Scheme, offers a unique blend of financial, cultural, and strategic advantages, aligning employees’ interests with the company’s success.

The trust, whether it’s a PTT or EST, provides the financial-legal mechanism for managing the shares and forms part of the ESS rules.

As the employer company prospers, so do the employees, creating financial incentives for performance and long-term commitment. This sense of ownership and commitment often fosters increased motivation and dedication among the workforce.

Fewer than 1-in-5 Australian business owners have a financial strategy for retirement in the form of a written plan.

An ESOP & EOT can be useful for business owners transitioning from their leadership role, often foregoing the need to put the business up for sale on the open market. In transitioning ownership to key personnel through shares, owners can ensure the continuity of their operations and leave a lasting legacy.

Employees benefit too! Most ESOPs are typically designed to function over two-to-15 years. As employees accumulate shares over their tenure, they can cash-in or sell their shares on exit or retirement.

The employer company benefits, as employees of ESOP-enabled firms tend to stay longer, reducing turnover costs and enhancing market value through institutional knowledge.

Let’s delve into the different tax implications, technical aspects, and legal considerations for an EST and PPT. Note, however, that the information in this article is general and should not be taken as legal or tax advice.

In any trust structure, some basics are a standard requirement for all plans:

Salary sacrifice is a voluntary arrangement where employees can choose to redirect a portion of their pre-tax salary towards specific benefits, such as your PPT. The ‘sacrificed’ amount is generally not subject to income tax. This can be especially attractive for higher income earners, provided they consider how and when they will ‘cash out’ of the trust.

Now you understand what are the benefits of an employee share trust. Many Australian mid-market businesses could benefit from creating one, and more are using them as part of their employee engagement and retention strategy.

Employee Share Trusts (ESTs) and Peak Performance Trusts (PPTs) are elegant ways to align employees and company interests. Each comes with its own set of challenges; navigating the intricacies demands careful consideration.

Our experienced Succession Plus advisers have a proven track record in tailoring plans to suit businesses of all sizes.

Ready to take the next step? Book a free consultation with a Succession Plus adviser today and trust us to help you pave the way for success.

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

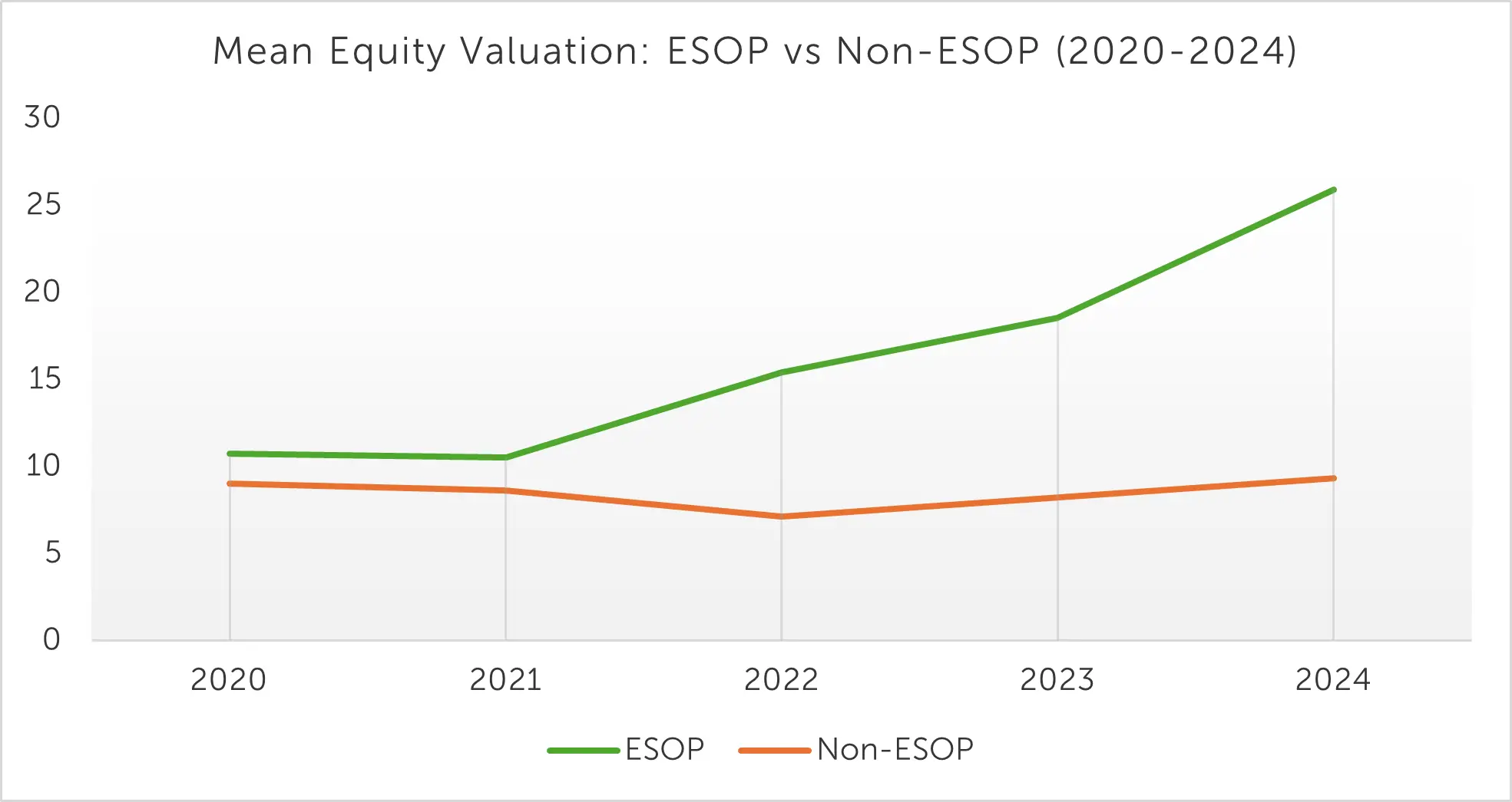

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

The 3x3 Framework | Business Growth & Succession Insights

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Smart ESOP Strategies Before Selling Your Busines