Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

Employee Share Ownership Plans (ESOP) can benefit new business owners, as they allow them to hire the best staff without worrying about the financial burden. In 2015, the government introduced tax concessions for Employee Share Schemes (ESS), making it easier for start-ups to offer ESS options to their employees.

To qualify for these ESS start up concessions, your company must be a private company not listed on any exchange and under ten years old. The turnover of all group companies combined should be less than $50 million, and it must be an active business, not an investment vehicle. The employer company must also be an Australian resident taxpayer.

If your company meets the eligibility criteria, your employees will not have to pay any upfront tax on their shares or options. They will only have to pay tax when they profit from their ESS interests. This usually happens when they sell the shares, or the company is sold or listed.

To be eligible for ESS interests, employees must hold them for three years unless they leave the company. Also, each employee cannot have more than 10% of shares in the company. ESS interests must be ordinary (voting) shares (or options over ordinary shares), and you can only offer up to a 15% discount on the value of the shares. ESS interests must be available to 75% of employees with over three years of service. When your company meets these criteria, employees will only be taxed on the Capital Gain (profit based on the increased value of the shares over time) when they sell.

If you don’t meet the eligibility criteria, you can still offer ESS options to your employees using a deferred tax plan under Div. 83A. This plan allows employees to defer the tax for up to 15 years, but they are still taxed. Alternatively, we can design custom ESOP plans to help you achieve specific business outcomes.

The ESS Start-up Concession allows employees to reduce the taxable discount income on their ESS interests to zero. It is only applicable for ESS interests acquired after 30 June 2015. To be eligible for this concession, the following conditions must be met:

The minimum holding period can be reduced if a written request is made. The request can be granted if the scheme’s intention was for all ESS interests to be held for three years after acquisition, or if all membership interests in the company were disposed of under an arrangement before the end of the three-year period.

If an employee acquires ESS interests under the Start-up Concession, they can also acquire ESS interests under another concessional or non-concessional scheme if offered by their employer.

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

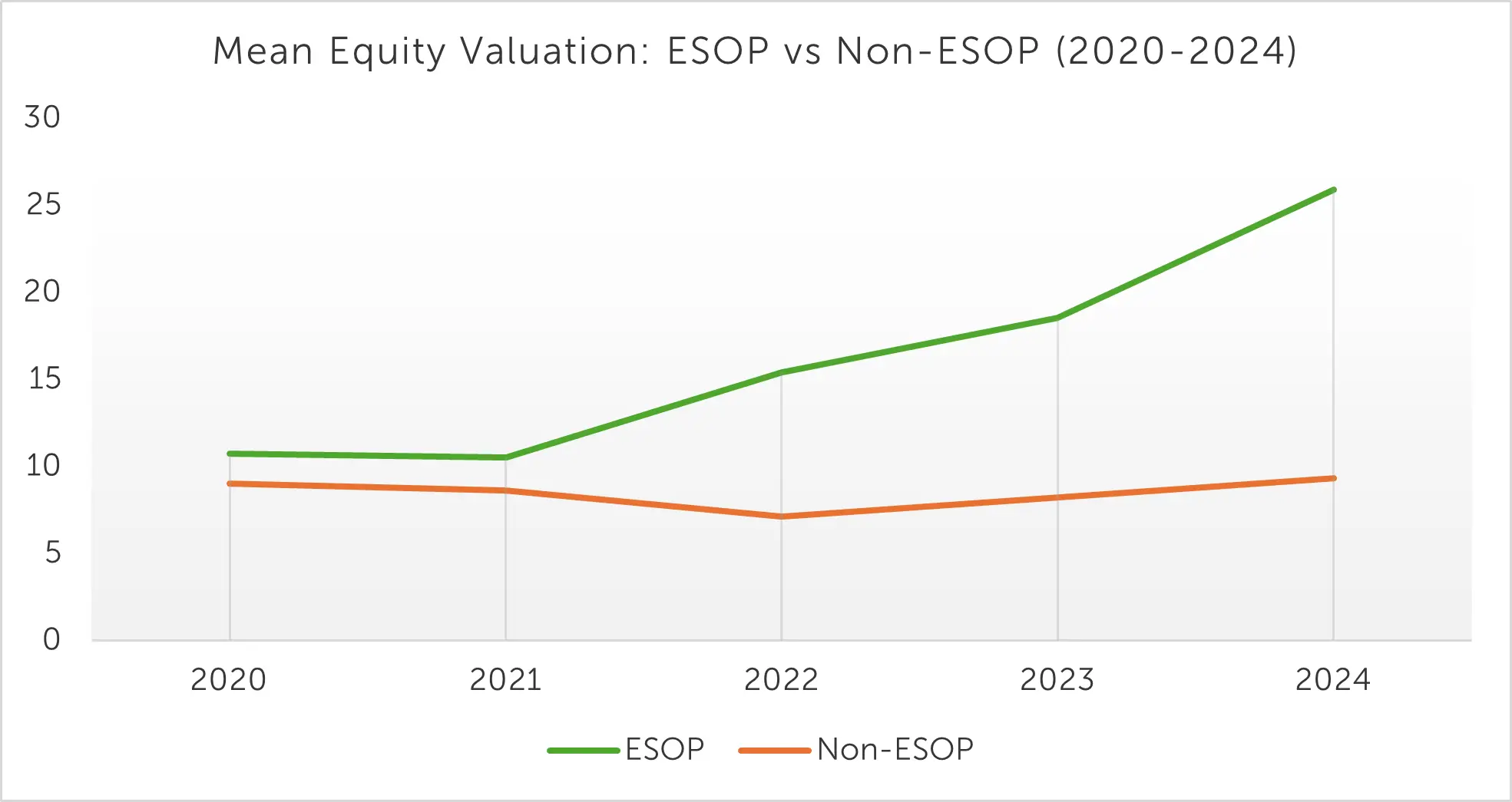

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

The 3x3 Framework | Business Growth & Succession Insights

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Smart ESOP Strategies Before Selling Your Busines