Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

Australia’s tight labor market has spurred companies to explore innovative strategies. Employee Share Ownership Plans (ESOPs) have emerged as a powerful tool to attract, retain, and motivate top talent. Watch our free webinar to find out how ESOP can increase staff engagement and safeguard the future succession of your business.

But unlocking the full potential of ESOPs hinges on choosing the right legal structure. You will need to choose wisely to maximise tax benefits and improve employee engagement. By equipping yourself with this knowledge, you can navigate the complexities with confidence and design an ESOP that perfectly aligns with your company’s unique needs and goals.

Here’s an overview of the legal structures typically used for ESOPs in Australia:

One of the most common methods for implementing an ESOP in Australia is through a trust structure. Here, an ESOP trust is established to hold the shares on behalf of the employees. This structure is particularly beneficial for tax deferral and can be flexible regarding how and when employees receive shares.

In Australia, an Employee Ownership Trust (EOT) is a structure used to facilitate employee ownership of a company. This structure is relatively new in Australia (Succession Plus set up the first one in 2006) compared to other countries like the UK. Still, it’s gaining popularity as a means of transferring ownership of a business to its employees.

Here’s a breakdown of the legal structure and considerations for an Employee Ownership Trust in Australia:

EOTs represent an innovative way to transition ownership of a company to its employees, fostering a culture of shared ownership and aligning the interests of employees with the success of the business. However, setting up an EOT requires careful planning, a clear understanding of legal and tax implications, and strategic management to realise its full benefits.

In this structure, shares are issued directly to employees. This can be done by offering new shares or existing shares. Direct ownership is straightforward but does not offer the same tax deferral benefits as the trust structure and provides very little asset protection.

Under this arrangement, employees are loaned funds by the company to purchase shares. This can be structured in various ways, often including provisions where the loan is gradually forgiven as long as the employee remains with the company.

A loan-funded share plan is a type of employee share ownership plan (ESOP) in Australia where employees are provided with a loan from the company to purchase shares in the company. This arrangement allows employees to become shareholders and participate in the company’s growth and success.

The legal structure of a Loan Funded Share Plan in Australia involves several key components:

Option plans give employees the right, but not the obligation, to purchase shares at a predetermined price after a certain period. This is a popular choice, especially for startups, as it provides employees with potential future benefits without immediate tax implications.

Option plans are a popular Employee Share Ownership Plan (ESOP) type in Australia. They provide employees with the right, but not the obligation, to purchase shares in their employer’s company at a predetermined price after a certain period.

This section delves into the legal structure and critical considerations for option plans in Australia:

With the increase in Employee Share Ownership Plans in recent times, the most important question to consider is: What is your business trying to achieve?

By implementing a plan and matching the correct legal structure, you can provide maximum benefit to not only your employees but to the business and the owners.

To learn more about Employee Share Ownership Plans (ESOP), you can attend this free ESOP webinar to see how to get your employees on board and help you accelerate your business growth.

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

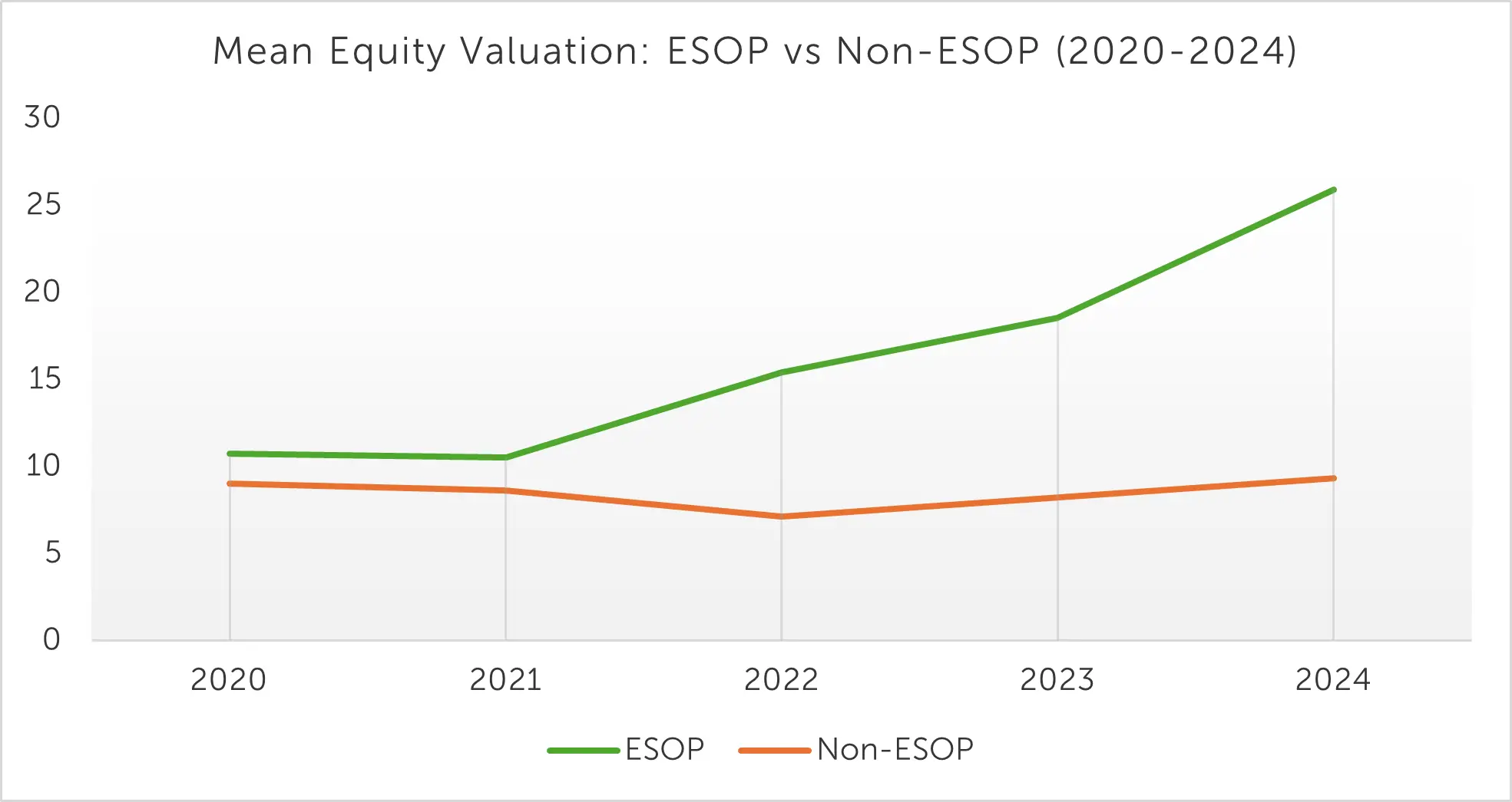

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

The 3x3 Framework | Business Growth & Succession Insights

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Smart ESOP Strategies Before Selling Your Busines