Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

In July 2015, new rules covering the taxation treatment of Employee Share Ownership Plans (ESOP) and Employee Share Schemes (ESS) were introduced, changing some existing taxation rules, unwinding some of the “poor” changes made in 2009, as well as introducing new concessions for employees of start-up companies. The changes applied to a group of plans which cover ESS interests (including shares, stapled securities, options and rights to acquire those on or after 1 July 2015).

The key changes to the existing rules were to extend the maximum deferral to 15 years for tax-deferred schemes, change the significant ownership test and allows a tax refund for rights received but not exercised, in certain circumstances.

In addition, new eligibility criteria (generous criteria which covered a large number of SMEs) for the start-up concessions allowed for the discount provided for eligible ESS interests to be untaxed. And finally, a new simplified “safe harbour” valuation regime was introduced to allow for easier and quicker valuation of unlisted shares.

Since 2015, we have worked with over 100 companies on Employee Share Ownership Plans (mainly using our proprietary Peak Performance Trust) and have tax rulings (the most recent in September 2020) which confirm the following taxation treatment:

To find out more about our taxation treatment and to review the ATO ruling documents, download our Technical Guide to ESOPs.

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

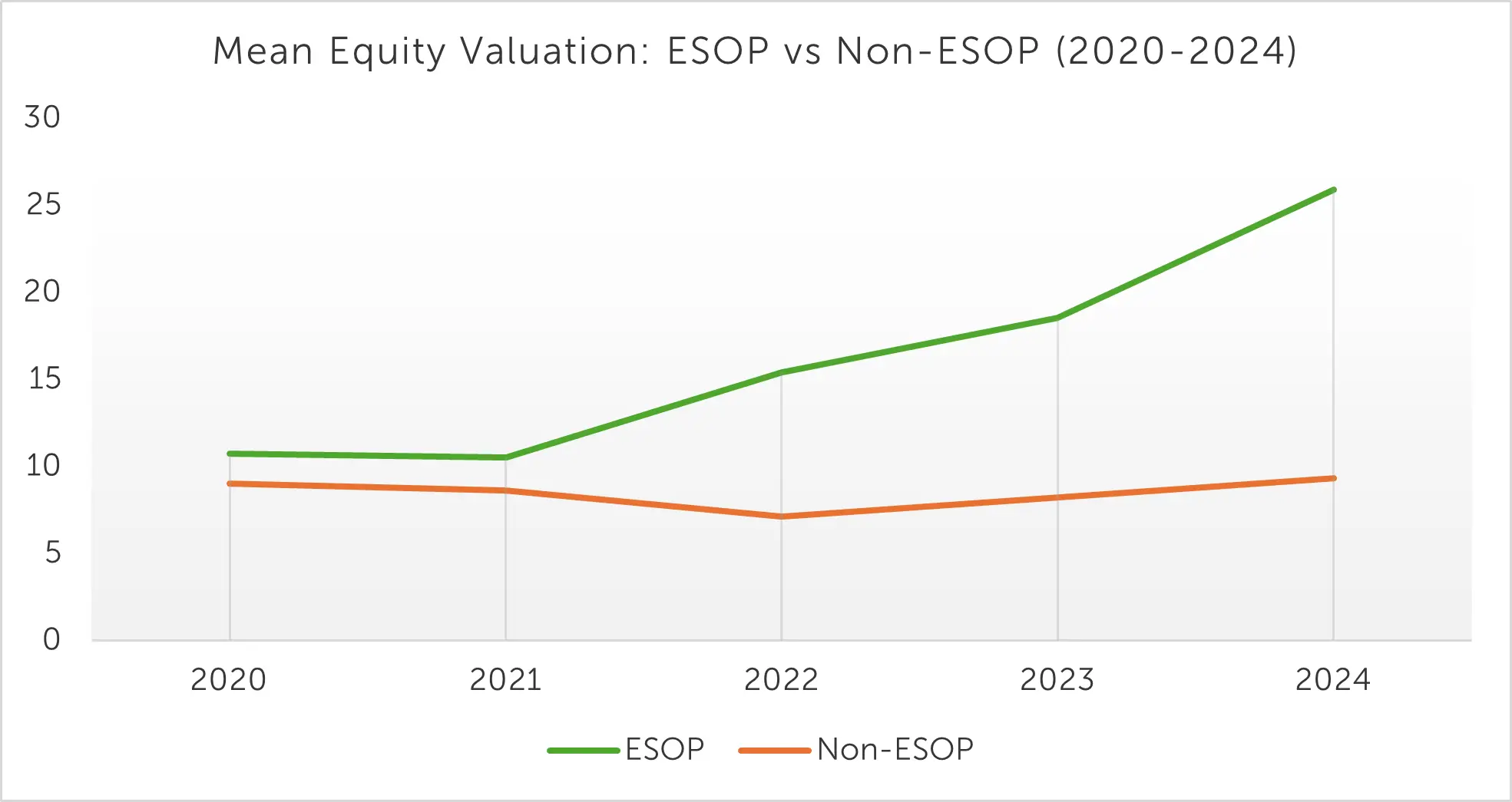

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

The 3x3 Framework | Business Growth & Succession Insights

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Smart ESOP Strategies Before Selling Your Busines