Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

Key Performance Indicators (KPIs) are vital for small businesses as they provide measurable values demonstrating how effectively a company achieves its key business objectives. KPIs should align with the business strategy to ensure they measure company progress and success through effective performance measurement. Additionally, KPIs cover various metrics related to financial, customer, and marketing aspects, all contributing to tracking and achieving business growth. For small businesses, KPIs should be specific, relevant, and achievable. Here are some examples and best practices:

Key Performance Indicators will ensure you are firstly, measuring and secondly, improving the key metrics that will deliver your business objectives. Whether you are trying to improve customer satisfaction, cash flow or financial metrics like gross profit margin your choice of the right key performance indicator is critical.

Peter Drucker said “If you can’t measure it – you can’t improve it” – this is especially true for small business owners who can use business KPIs to manage the company’s ability to achieve its goals. Utilising KPIs allows small business owners to make data-driven decisions that can significantly impact their company’s success. Unfortunately for many, there is just too much to measure – gross profit, net profit, operating costs, revenue growth rate, accounts receivable, inventory turnover, quick ratio, new customers, average order, revenue, sales, current liabilities etc. – this list of metrics to track could be three pages long.

Finding the important business KPIs to ensure the business is financially healthy and can achieve its strategic objectives is the first place to start for a small business owner.

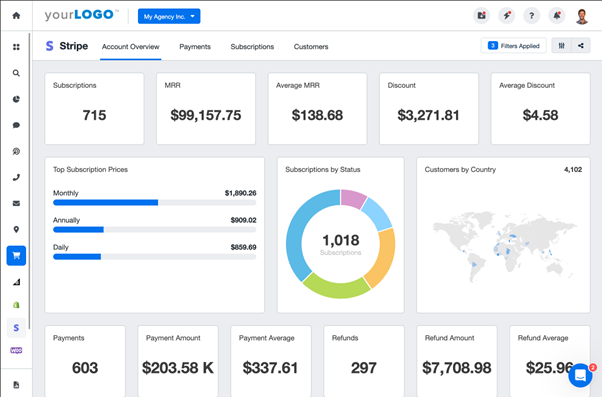

In many cases, we utilise KPIs with Succession Plus clients for two main reasons – to measure and improve performance as part of our value acceleration programs and also to help determine the best way to allocate shares in our Employee Share Ownership Plans (ESOP).

Financial KPIs are crucial for assessing the financial health of a small business.

KPIs are not just metrics; they reflect the business’s strategy and operational effectiveness. For small businesses, they are tools for growth, providing insights that help steer the business in the right direction.

In a professional services firm, tracking a variety of financial metrics is essential to understand and improve business performance. Fortunately, modern software packages have made it easier for business owners to monitor these metrics, which were historically limited to basic measures like cash flow (bank balance) and net profit. By expanding the scope of tracked metrics, business owners can gain deeper insights into their company’s strengths and weaknesses, allowing for more informed decision-making and strategic planning. Here are some key performance indicators (KPIs) that small businesses in professional services should consider:

Monitoring these KPIs helps ensure that the business is financially healthy and on track to meet its strategic goals. Regular review and analysis of these metrics can highlight areas for improvement and inform necessary adjustments.

Monitoring project KPIs allows firms to assess the efficiency and effectiveness of their project management processes, ensuring that they can deliver high-quality results to clients while managing resources effectively.

Tracking individual performance through these KPIs helps identify top performers and areas where additional support or training may be needed. It also ensures that employees’ efforts are aligned with the firm’s strategic objectives.

By leveraging these KPIs, small businesses in professional services can gain comprehensive insights into their financial health, project management efficiency, and individual employee performance. Regularly monitoring and acting on these metrics will help ensure that the business remains competitive, profitable, and poised for growth.

Effective KPIs are essential tools for small businesses aiming to track performance, achieve strategic goals, and drive growth. By aligning KPIs with your business strategy, you can make data-driven decisions that enhance financial health, customer satisfaction, and operational efficiency. At Succession Plus, we specialise in helping businesses like yours identify and implement the right KPIs to ensure sustainable success.

Don’t navigate this journey alone. Contact us today to determine where your business stands and how we can assist in improving your performance. Together, we can set your business on a path to achieve its full potential.

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

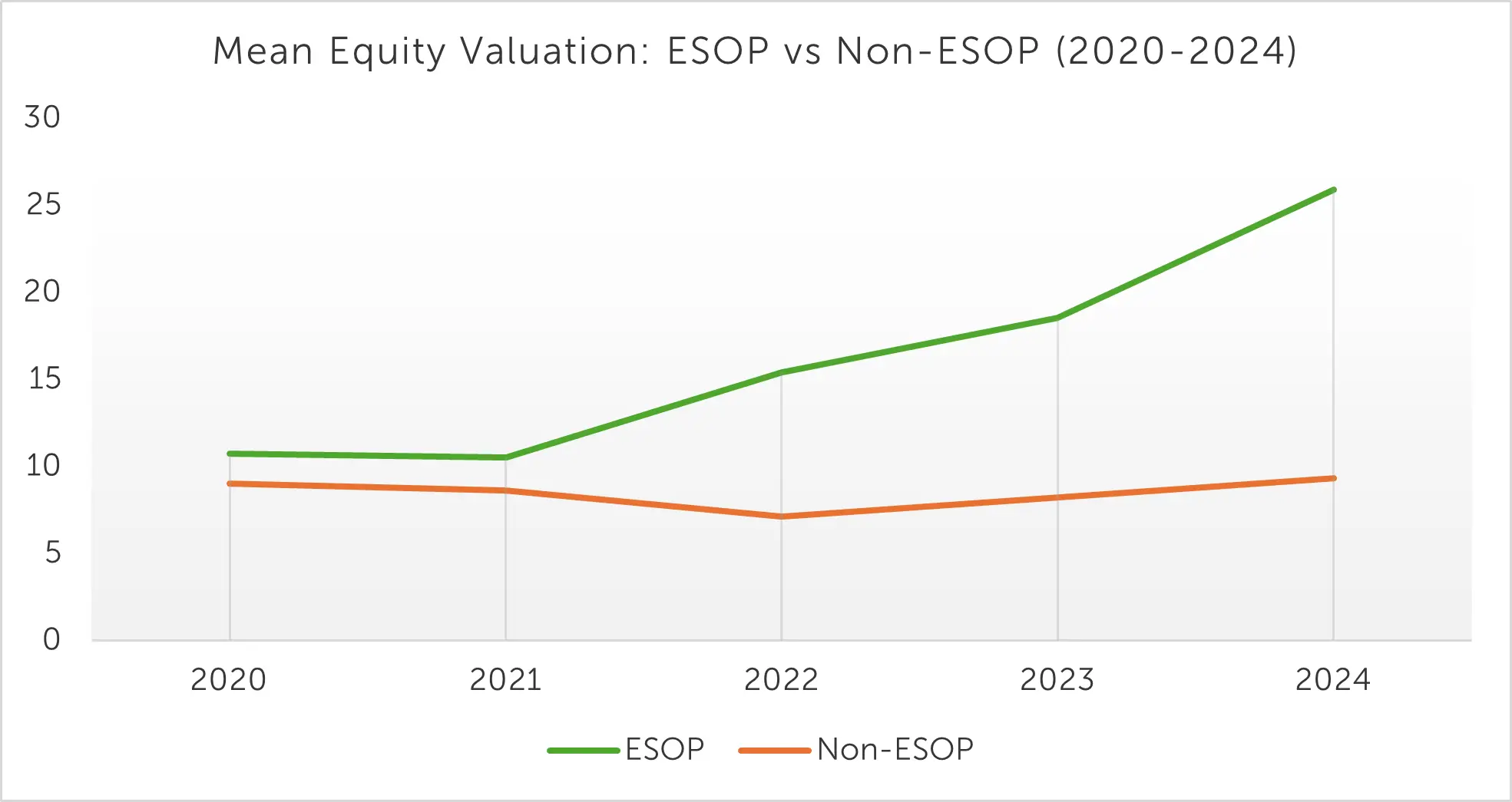

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

The 3x3 Framework | Business Growth & Succession Insights

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Smart ESOP Strategies Before Selling Your Busines