Succession Planning

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Succession Planning

Family businesses play a significant role in the Australian economy. Here are some key statistics:

These statistics from KPMG’s Australian Family Business Survey highlight the resilience and adaptability of family businesses in Australia, even in periods of challenge and uncertainty. They continue to manage the complexities of digital transformation, generational transition, and shifts in societal expectations.

Unfortunately, family businesses are complicated entities. Owners, family members and employees are often one and the same. The lack of delineation in roles and responsibilities can lead to dysfunction in the workplace and fractures in personal relationships. Understanding the Three-Circle model, and how it works to separate these roles can be a key to success for business families.

Business family entities are where business, ownership, and family systems intersect. Family dynamics can have an outsized, emotionally led effect on business operations and succession planning. Just look at the four seasons of high drama in HBO’s Succession, or, more recently, the carnage of contested family succession plans in GOT: House of the Dragon.

But putting questions of who will end up on the Iron Throne aside for a moment, the Three-Circle Model of Family Business System provides a framework to analyse the roles and relationships within a family enterprise, ensuring clarity and effective governance. Understanding these systems is crucial for the longevity and success of the business.

The Three-Circle Model of the Family Business System framework was developed by Renato Tagiuri and John Davis at Harvard Business School in 1978. The significance of this model was highlighted in the classic article ‘Bivalent Attributes of the Family Firm’ in the Family Business Review published in 1996. This model was first published in Davis’ doctoral dissertation in 1982 and subsequently in Tagiuri and Davis’ article.

This model is used worldwide for understanding and analysing family business systems.

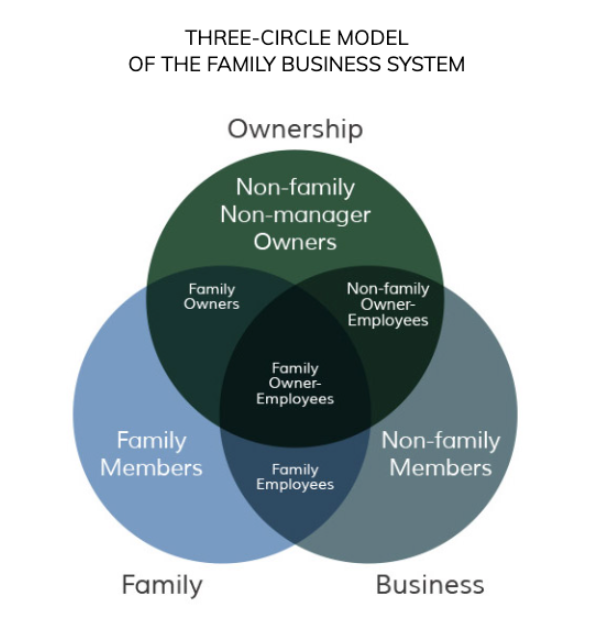

The model consists of three interdependent and overlapping groups:

As a result of this overlap, there are seven interest groups present, each with its own legitimate perspectives, goals, and dynamics. The long-term success of family business systems depends on the functioning and mutual support of each of these groups.

The ‘three-circle model’ divides the family business system into three interconnected subsystems: business, ownership, and family. Each circle represents a different group of individuals associated with the family business: those involved in management, those who own the business, and the family members not directly involved in the business.

The following diagram illustrates the three-circle model of family business systems and helps in identifying the overlapping areas and the unique challenges that arise at these intersections:

Each circle represents a group of individuals with different roles, interests, and expectations.

The circles are labeled as follows:

The intersections of the circles create seven segments, each representing a different sub-system within the family business. These segments are as follows:

Understanding these segments and their interactions can help family businesses address the issues and opportunities that arise from the overlap of the three circles. It’s also important to recognise that people may transition from one segment to another, which must be carefully managed as the move can create new conflicts and shift an established power balance.

For example, some common questions that can be answered by using the three-circle model are:

By applying the three-circle model, family businesses can identify the sources of complexity and diversity in their system, and develop appropriate strategies and structures to ensure clarity and effective governance. Beyond succession planning, this can enhance the sustainability and success of the family business across generations.

Succession planning in family businesses is a delicate process that requires a well-defined business strategy to balance the needs and expectations of the business with those of the family. The three-circle model aids in this process by providing a clear understanding of the roles and potential conflicts, ensuring a smooth transition of leadership and ownership.

Succession planning is a multi-step process that involves identifying and developing new leaders who can replace current leaders when they leave, retire, or pass away. A detailed succession plan is a critical tool for business continuation, as well as for each owners’ financial future.

Involving succession candidates in critical business operations, such as mergers & acquisitions and relationship management, is a critical strategic plan for the sustainability of a family business.

Succession planning ensures the continued operation of a business after the departure of important leaders. It’s not just about replacing personnel but about preserving the legacy and values of the family business while driving it forward.

The preferred ownership exit strategy will determine the type of succession plan required. For example, an owner may wish wind back daily responsibilities over a few years, sell to a business partner by a set date, retire but retain a board position, or leave entirely to start a new venture.

Family companies must prioritise succession planning to ensure the continuity and longevity of their legacy. The “Five Stages of Value Approach” provides a structured framework to guide business owners through this complex journey.

Here’s an in-depth look at each stage:

The first stage is about understanding the current value of the business and setting goals for the future. It involves a comprehensive review of the business to identify factors that may prevent owners from maximising their valuation and exiting on their terms. This stage, influenced by the life stages of the owners and key stakeholders, sets the foundation for the entire succession process, as it clarifies the owner’s objectives and the business’s worth.

Once the value is identified, the next step is to protect it. This involves financial planning to ensure that the owner’s personal financial goals are aligned with the business’s performance. It also includes planning for unplanned events and de-risking the business to protect its value against unforeseen circumstances.

In this stage, business owners work on strategies to enhance the value of their business. This could involve exploring exit options, strategic planning, and improving business systems and procedures. The goal is to increase the business’s attractiveness to potential successors or buyers, thereby maximising the value for a future sale or transfer.

The fourth stage focuses on extracting the value that has been identified, protected, and maximised. This involves preparing for the liquidity event, which could be a sale or transfer of the business. Tax planning and documentation are key components of this stage, ensuring that the transition is as profitable and smooth as possible.

The final stage is about managing the value post-transition. This includes ongoing investment planning, asset protection, and estate planning. It ensures that the financial rewards from the succession are preserved and managed effectively for the future, taking into account the dynamics of, say, the father-son work relationships within the family business.

The “Five Stages of Value Approach” is a holistic and comprehensive process that covers all aspects of business succession planning. It’s designed to help family business owners not only plan for a successful transition but also to achieve their financial objectives and secure their legacy. By following this approach, business owners can navigate the complexities of succession with confidence and strategic foresight.

For a detailed example of these stages in action, business owners can refer to the Enjoy It eBook by Dr. Craig West — which outlines the 21-step process to traverse these five stages with confidence.

Best practices for succession planning in family businesses include:

In conclusion, the three-circle model is a powerful tool for understanding and managing the complex dynamics of a family business. By following a structured succession planning process and best practices, family businesses can ensure their longevity and success for generations to come.

For both a legacy and financial security of the family, businesses must also integrate best-in-class business practices into daily operations, as recommended as part of the 21-step Business Succession and Exit planning model. This involves a holistic approach to business succession and exit planning, focusing on maximising business value, personal financial planning, and life after business planning.

Get free chapter of Enjoy It by Dr. Craig West to get more practical advice and a deeper understanding of the financial implications of succession.

In the book, you’ll see the proven steps involved in ensuring a successful transition for your family business. No matter if you have an idea of an exit outcome, have already started the process, or have just begun to think about succession planning, the book outlines practical methods you can tailor to the unique needs of the business and its owners’ financial objectives.

(btw – The complete copy is available now on Apple Books, Amazon and Smashwords).

Dr Craig West

1 min read

1 min read

Dec 8, 2025 | Resources Succession Planning

The Role of Corporate Governance in Succession and Exit Planning

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

2 min read

2 min read

Oct 16, 2025 | Resources Succession Planning

Business Exit Pathway Options Guide | Succession Plus

.webp) 2 min read

2 min read

Oct 14, 2025 | Resources Succession Planning

Legal Readiness Checklist for Business Exit Planning