Employee Ownership, Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership, Business Value Acceleration

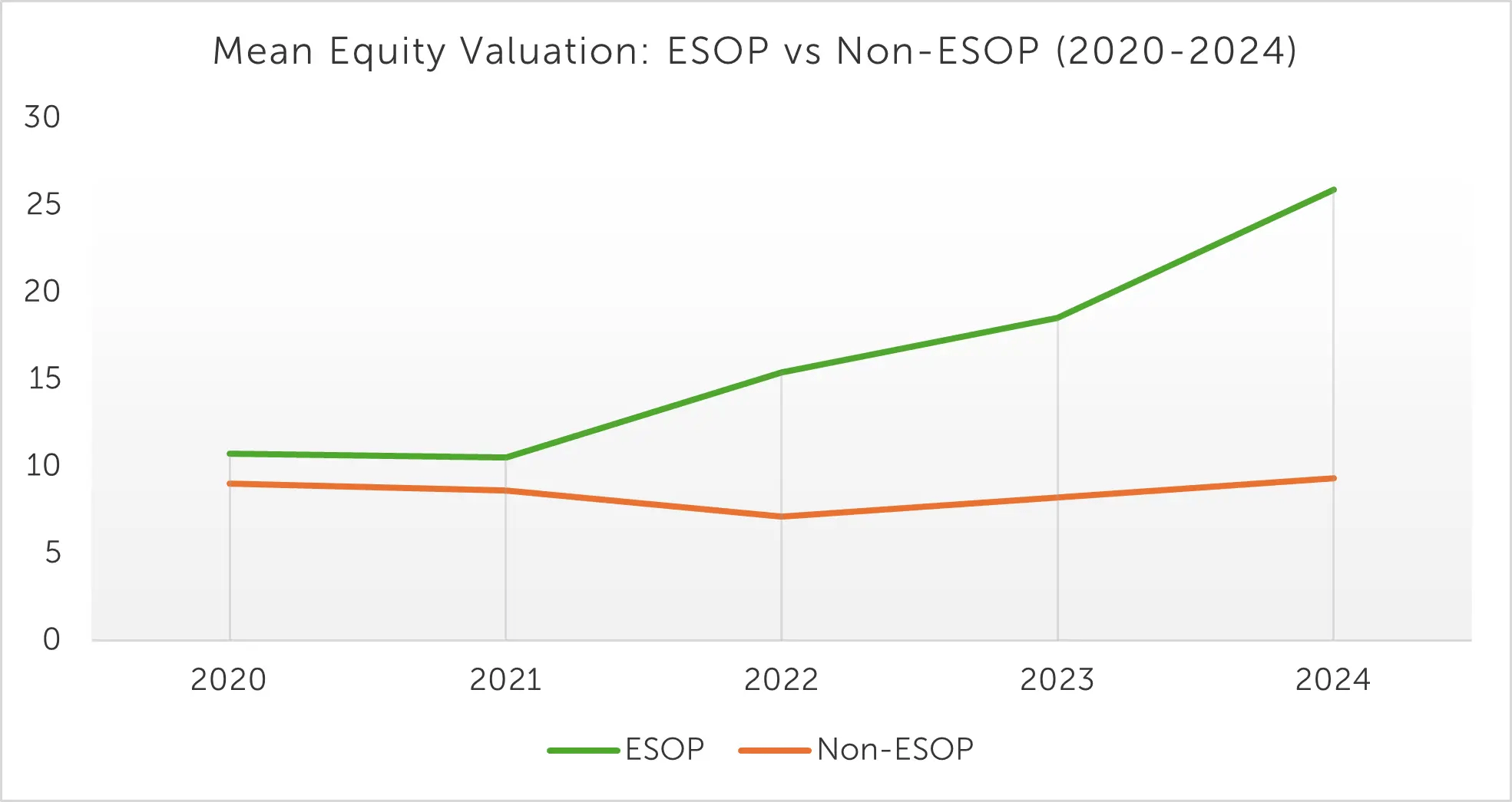

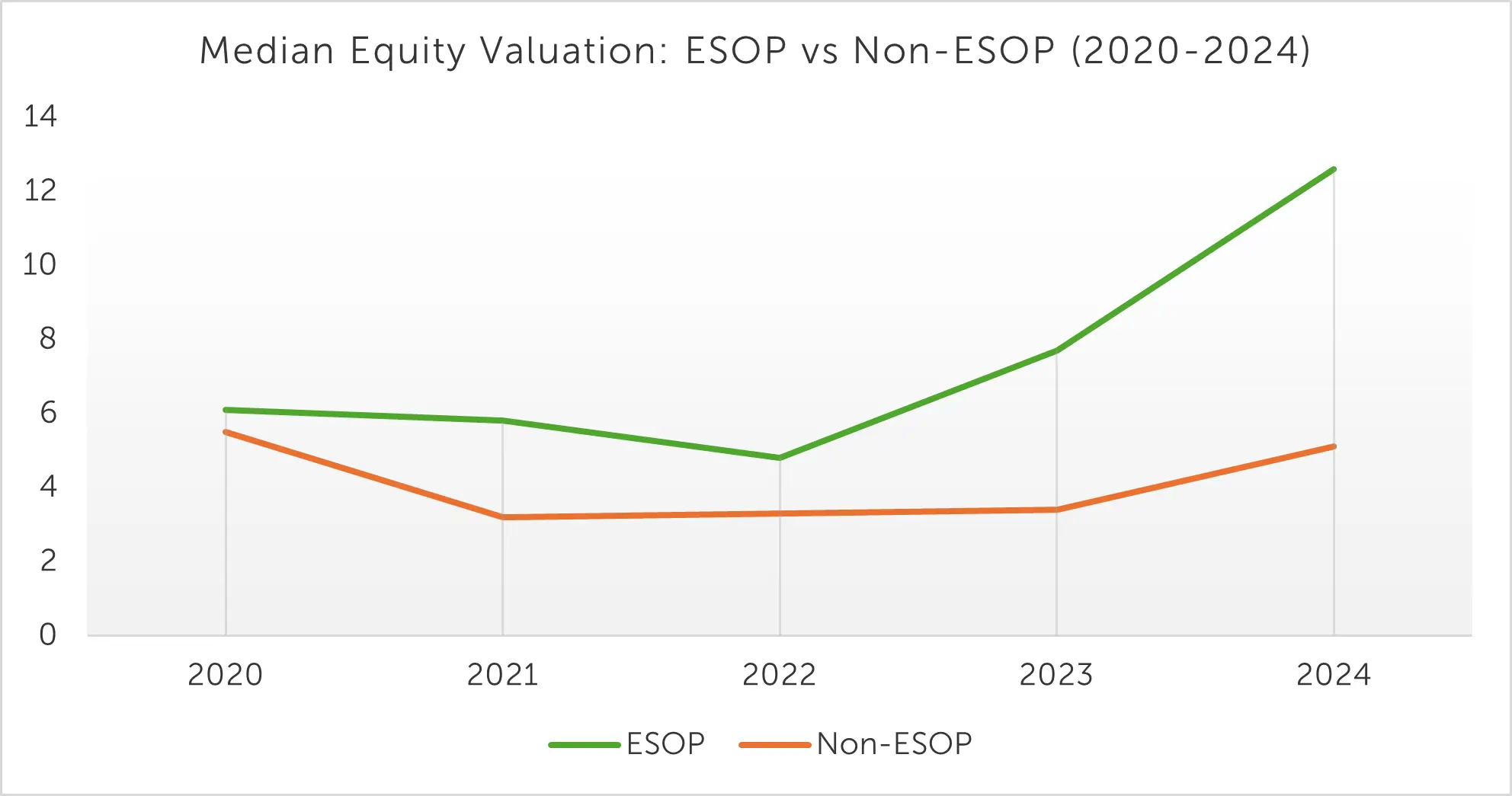

In the evolving landscape of private business performance, one factor stands out as a consistent driver of value: employee ownership. Recent analysis of equity valuation data from over 250 Australian private companies reveals a compelling trend: firms with an Employee Share Ownership Plan (ESOP) not only start ahead in valuation but accelerate faster over time.

Two simple line graphs; one tracking median equity valuation, the other mean, tell the story. Each compares ESOP and non-ESOP companies over a five-year span (2020–2024). The green line represents ESOP firms; the orange line, those without.

Insightful numbers behind the plots for the ESOP cohort versus its non-ESOP peer are as follows:

Median equity valuation:A consistent lead for ESOP firms: the green traces always sit above the orange ones. Whether mean or median, companies with ESOP tend to have larger equity values than those without.

Strong growth for the ESOP cohort: over five years, median values more than double and mean values nearly triple, especially between 2022–2024.

Modest movement for non-ESOP firms: medians and means of non-ESOPs remain fairly flat.

Mean versus median: the distribution is right-skewed. Means are consistently above medians in both cohorts, dramatically so for ESOP in later years, indicating a few high-performing ESOP companies set the pace.

The equity valuation trends from 2020 to 2024 paint a clear picture: ESOP companies are not only keeping pace but also thriving. A business that gives employees a stake appears to start ahead in value and accelerate away from peers. By 2024, the typical ESOP firm is worth more than twice what it was at the start of the decade and 2 to 3 times what a comparable non-ESOP business fetches.

Interpreted with due caution for sample composition and other factors, these findings support the intuitive benefits of employee ownership: stronger incentive alignment, engagement, and cohesion drive measurable value creation.

Dr Craig West

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

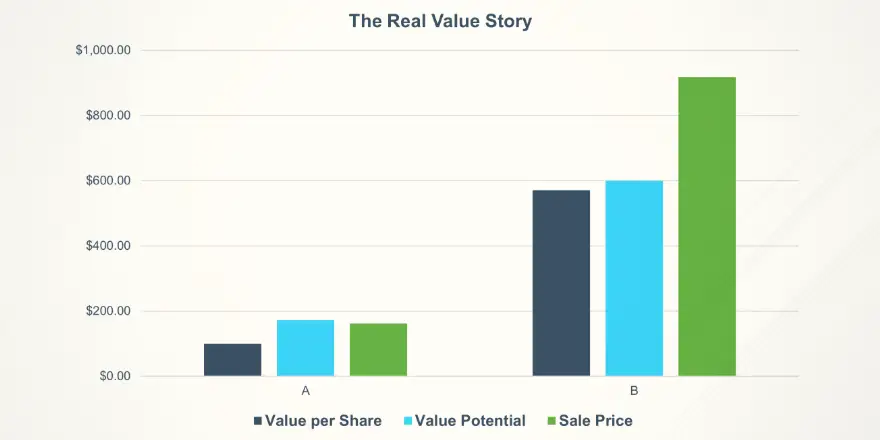

Unlock Your Business’s True Value Potential

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

3 min read

3 min read

Oct 8, 2025 | Business Value Acceleration

Preparation Drives Premium | Strategy to Sale Results

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value