Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Business Value Acceleration

-Jan-12-2026-01-36-34-4947-AM.png?width=1200&height=628&name=Untitled%20(2)-Jan-12-2026-01-36-34-4947-AM.png) Every business owner knows their company has value - but do you know it's value potential? Understanding what your business is worth today versus what it could or should be worth is the first step toward maximising enterprise value and achieving a successful exit.

Every business owner knows their company has value - but do you know it's value potential? Understanding what your business is worth today versus what it could or should be worth is the first step toward maximising enterprise value and achieving a successful exit.

Your business valuation isn’t just a number - it’s a strategic tool. It influences:

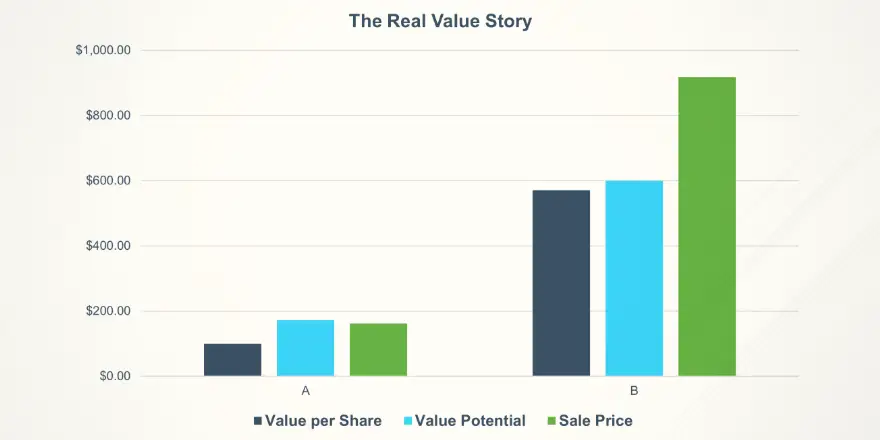

The reality? Most businesses have a Value Gap - the difference between current valuation and potential valuation. Closing that gap can mean millions in additional wealth creation.

Take a look at these real-world results from businesses that implemented the Succession Plus process:

Example 1:

.png?width=1288&height=693&name=Screenshot%202026-01-04%20at%2009.26.09%20(002).png)

Example 2:

These results aren’t luck - they’re the outcome of a proven methodology focused on value acceleration, succession planning, and exit readiness.

Our Business Succession and Exit Planning Process is designed to:

Don’t leave millions on the table. Start by understanding your business’s current value and its potential.

Use our Value Gap Assessment Tool to understand your business value today and what it could or should be worth.

Looking to take the next step? Explore how we can help you unlock value:

Dr Craig West

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

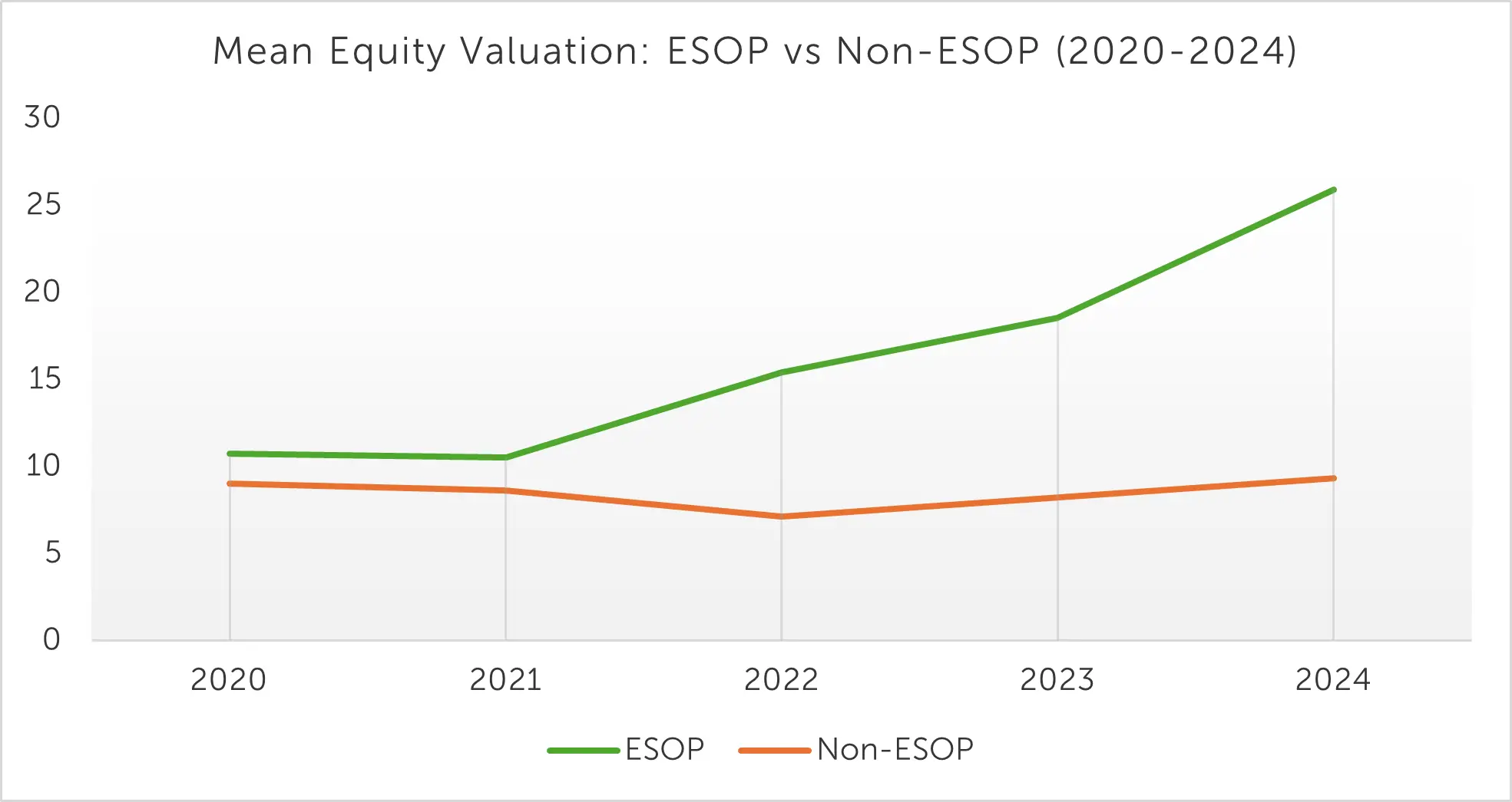

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

3 min read

3 min read

Oct 8, 2025 | Business Value Acceleration

Preparation Drives Premium | Strategy to Sale Results

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value