Succession Planning, Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Succession Planning, Business Value Acceleration

For most business owners, the day-to-day takes priority. Clients need attention, staff need guidance, and the financials always need reviewing. With so much focus on today, it's no surprise that planning for the end, meaning your succession or exit, gets pushed to “later.”

But what if your exit wasn’t just a final event? What if it was actually the driver for building a better business today?

At Succession Plus, we’ve worked with hundreds of business owners who thought they had years before needing to consider succession. But the most successful exits don’t happen at the end of a business journey, they’re the result of decisions made early, deliberately, and strategically.

This article explores how to view succession planning as more than just a financial transaction or retirement plan. It’s about creating a sustainable, valuable business and giving yourself real choices for the future.

Succession planning is often misunderstood. It’s not simply about naming a successor or preparing to sell the business. It’s about building a business that’s not dependent on you, where value is embedded in systems, people, and processes, not just the founder’s relationships or reputation.

Done well, it:

And perhaps most importantly, it gives you control over how and when you leave.

Despite its importance, many owners delay succession planning. Some are too busy. Others are unsure where to start. But more often than not, the hesitation is emotional.

"What will I do after I leave?"

"Will the next owner maintain my standards?"

"What if the business fails without me?"

These are real and valid concerns. But avoiding succession planning because of them creates much greater risk—not just for you, but for everyone who depends on your business.

The sooner you start, the more time you have to build resilience, groom successors, and shape your own legacy.

One of the most powerful concepts in succession and exit planning is the Value Gap.

The Value Gap is the difference between what your business is worth today and what it could be worth if you addressed key issues in the business.

It’s not about inflated expectations or market hype. It’s about unlocking the trapped value inside your business by improving performance, reducing reliance on the founder, tightening systems, and enhancing governance.

For example:

The good news? These problems are fixable.

At Succession Plus, our first step is always to assess where the business is today through tools like our Business Insights Report, so we can measure the value gap and build a plan to close it.

Many owners are unknowingly the bottleneck in their own business. They’re the key decision-maker, the top salesperson, and the fixer-of-everything.

While that might keep things running today, it’s a problem for future transition. If your business relies on you to function, it’s not transferable, and if it’s not transferable, it’s not valuable.

Reducing founder dependency takes time. It requires:

The payoff? A business that runs smoothly with or without you and is worth far more as a result.

Another overlooked area in succession planning is the impact on your team.

When high-performing people don’t see a clear future in your business, they leave. And once they go, they take knowledge, client relationships, and potential with them.

Strong succession planning:

Your team is one of your greatest assets. Keeping them engaged and aligned is key to both performance now and value at exit.

In many private businesses, especially professional services firms, decision-making structures are informal. Everyone wears multiple hats, and owners often equate ownership with control.

But as a business grows, and especially when preparing for succession, that model breaks down.

Without governance:

By introducing governance structures like advisory boards, clear decision rights, and defined leadership roles, you not only prepare for succession but improve business performance today.

While succession and exit are often seen as long-term issues, the reality is that half of all business exits are unplanned.

Whether due to illness, death, divorce, or disputes, these unexpected events can destroy value overnight.

A strong succession plan includes:

These are not “nice-to-haves”. They’re essential for protecting the business and the owner’s personal wealth.

One of the most powerful aspects of strategic succession planning is the ability to align business performance with your personal goals.

Too often, owners are working hard in the business without stepping back to ask:

By answering these questions early and building them into your business strategy, you ensure that the exit is not just profitable, but personally fulfilling.

This is where we start at Succession Plus:

These steps form the foundation of a real plan, not just to leave your business, but to transition on your terms.

Succession is often treated as a one-time event: sell the business, sign the documents, walk away.

But we see it differently.

It’s a transformation of the business from one that relies on the founder to one that is built to last.

It’s a transition of leadership, knowledge, and relationships.

And for the owner, it’s a life change that should be prepared for just as seriously as the business sale.

When done right, succession planning leads to:

If you’re waiting for the “right time” to start succession planning, you’ll likely wait too long.

The best time to start is when you're not under pressure. It's when you can think clearly, involve the right people, and make decisions strategically rather than reactively.

You don’t need to solve everything overnight. But taking the first steps like clarifying goals, assessing value, identifying risks prepares you for long-term success.

As we often say at Succession Plus:

“Build a business you can leave. Then decide if you want to.”

Start by identifying the Value Gap in your business. Our Value Gap Assessment Tool gives you a quick, objective way to measure the difference between your current business value and its potential.

👉 Click here to access the tool now.

Dr Craig West

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

Unlock Your Business’s True Value Potential

1 min read

1 min read

Dec 8, 2025 | Resources Succession Planning

The Role of Corporate Governance in Succession and Exit Planning

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

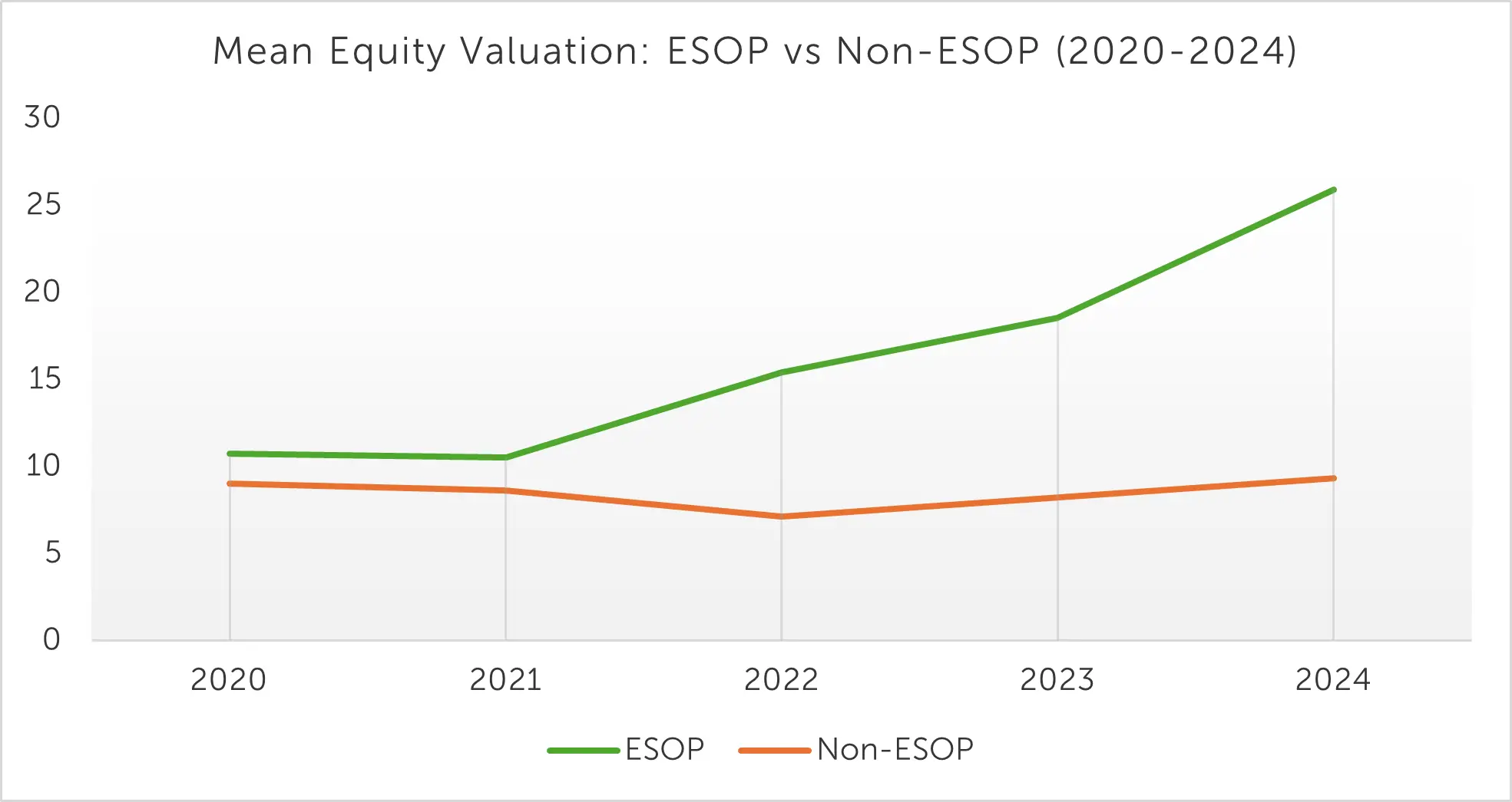

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth