Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

When it comes to deciding between a Peak Performance Trust and an Employee Share Ownership Plan (ESOP) for your company, it is essential to understand the differences between the two to make an informed decision.

To begin with, a Peak Performance Trust is a type of equity-based incentive plan that rewards employees based on the company’s performance.

There are benefits associated with both options, but also some potential downsides to consider. For instance, a Peak Performance Trust has the potential to motivate employees to work harder and achieve better results. It also gives companies more flexibility in terms of how they distribute rewards, as they can choose how much to contribute to the trust each year. The Peak Performance Trust uses very generous ESS tax concessions to enable the employee to defer tax on income they receive as a contribution to the share plan – This tax treatment is supported by ATO rulings – https://succession.plus/esop/ppt-private-rulings/

The Peak Performance Trust has been designed specifically for Australian privately owned companies and is the most flexible plan available in the market – for example:

The employee can own shares through an associate – a family trust is most common.

One of the key benefits of the PPT is the flexibility of funding- the plan allows for various funding options to allow employees to buy or earn shares. The plan can be funded through at least five different methods –

In summary, the PPT offers employees a sense of ownership and pride in the company’s success. By becoming shareholders, they have a vested interest in the company’s performance and are more likely to work towards its success. Additionally, a PPT can provide tax benefits for both the company and the employees.

For further information on Peak Performance Trusts, please refer to https://succession.plus/white-paper/ppt-overview/.

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

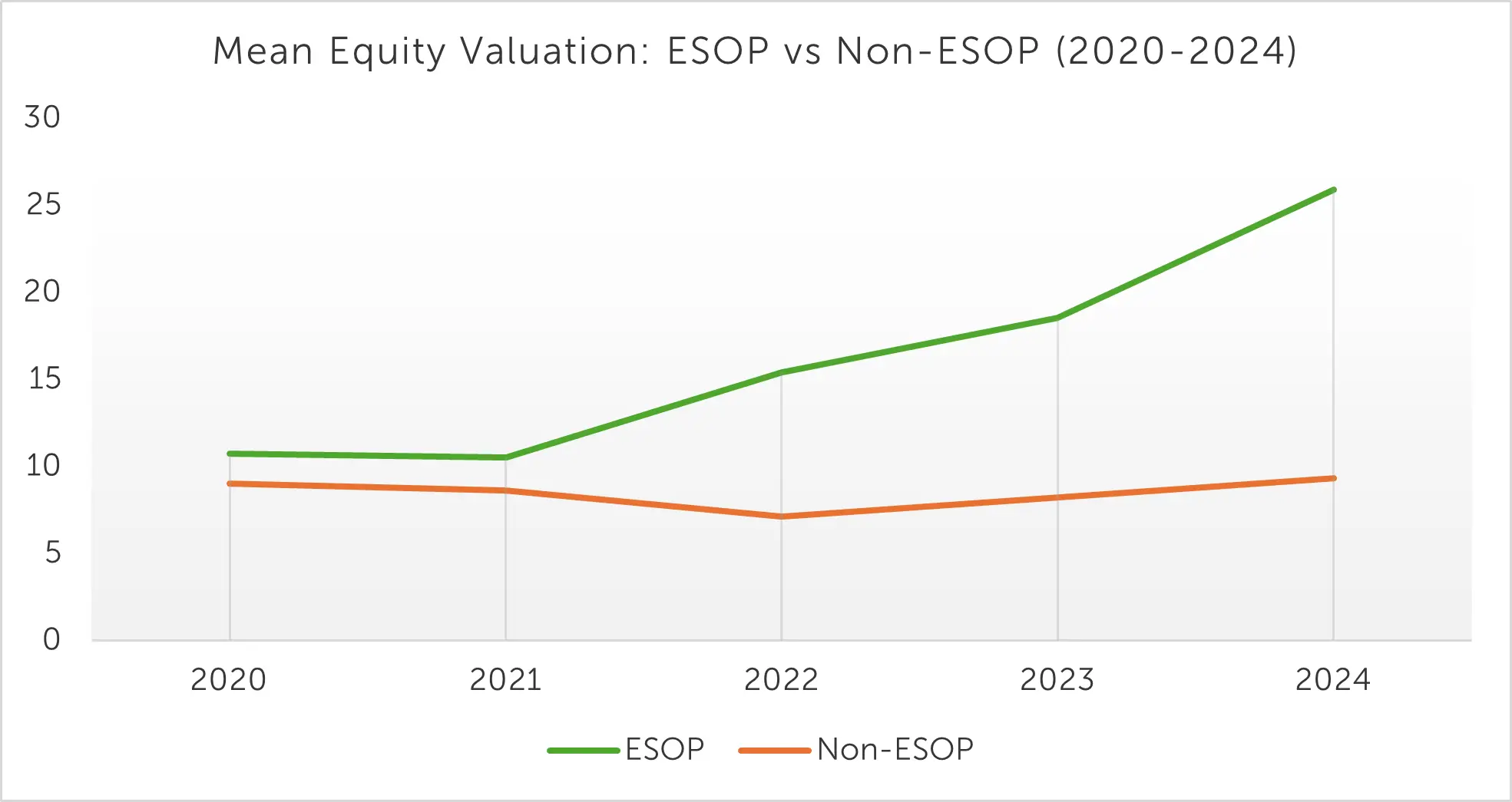

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

The 3x3 Framework | Business Growth & Succession Insights

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Smart ESOP Strategies Before Selling Your Busines