Resources, Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Resources, Business Value Acceleration

.webp?width=880&height=440&name=Value%20Potential%20Index%20(2).webp)

Australian businesses hold enormous untapped value.

The latest Value Potential Index (VPI) Report – Australia, Q1 2025 reveals that while the total value of privately owned businesses sits at $1.437 trillion, there is still $432 billion in unrealised potential waiting to be unlocked—an average of $182,000 per business.

For advisers and business owners, this represents a major opportunity: to bridge the “value gap” and turn hidden potential into measurable growth and stronger exit outcomes.

📊 Q1 2025 market trends: insights into ASX performance, GDP, inflation, and employment

💡 Where the value lies: which factors drive the gap between current and potential value

🔍 Practical guidance: how advisers and owners can use the VPI to prioritise improvements

📈 Actionable opportunities: strategies to strengthen profitability, reduce risk, and boost multiples

The VPI is built on 13 years of data and over 800 business valuations, combining economic indicators, industry benchmarks, and business performance metrics.

It’s more than a report—it’s a decision-making tool to help:

📥 Get the Q1 2025 VPI Report

Understand where Australian businesses stand today—and where they could go tomorrow.

Dr Craig West

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

Unlock Your Business’s True Value Potential

1 min read

1 min read

Dec 8, 2025 | Resources Succession Planning

The Role of Corporate Governance in Succession and Exit Planning

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

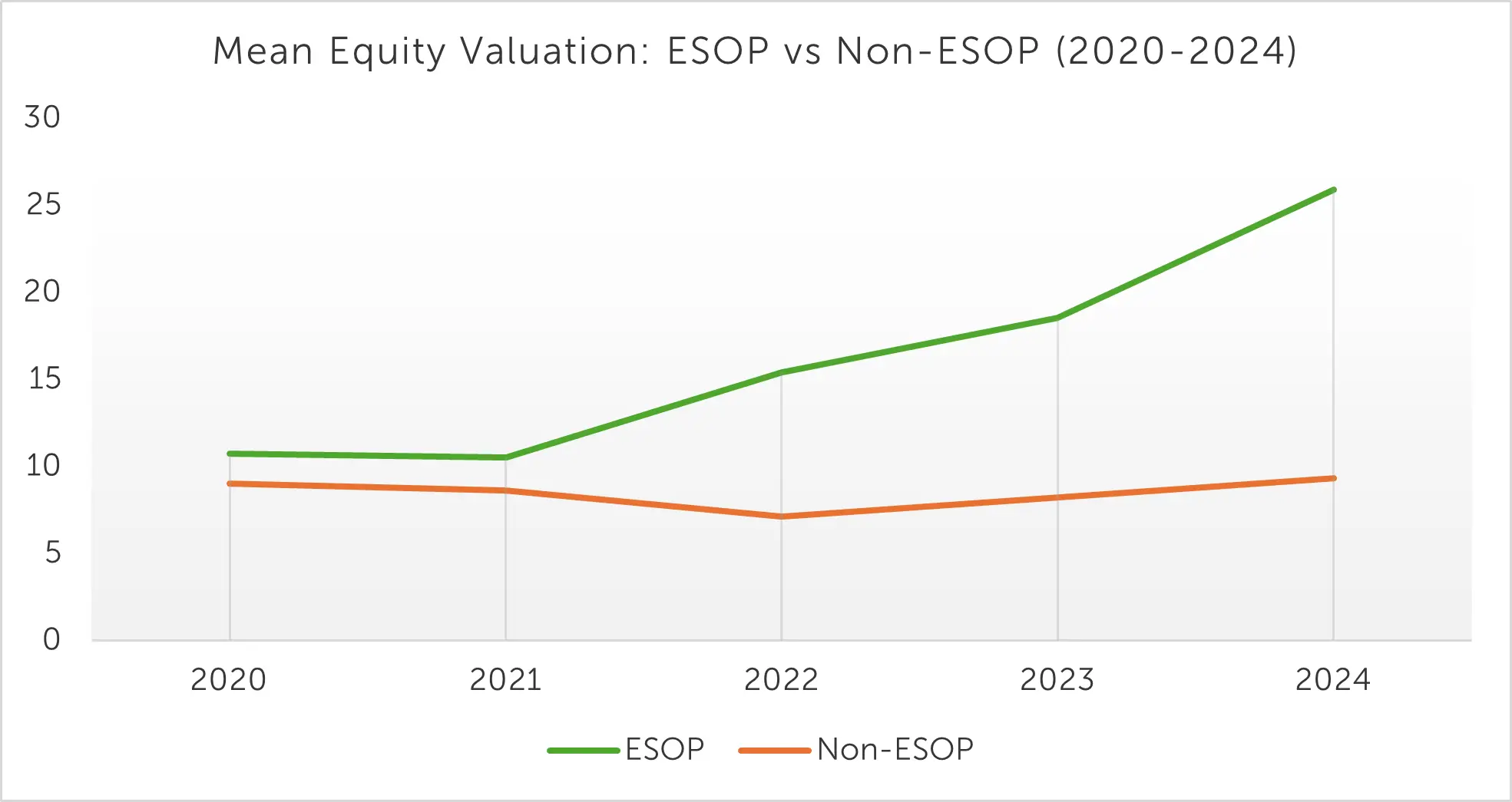

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth