Employee Ownership, Business Value Acceleration

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership, Business Value Acceleration

For many business owners, the decision to sell their company is one of the most significant milestones in their professional journey. Whether driven by retirement, moving onto "the next thing,” succession planning, or strategic repositioning, the sale of a business is not just a financial transaction but a legacy moment. One increasingly popular strategy to enhance valuation, reduce risk, and attract high-quality buyers is the implementation of an Employee Share Ownership Plan (ESOP) in the lead-up to the sale.

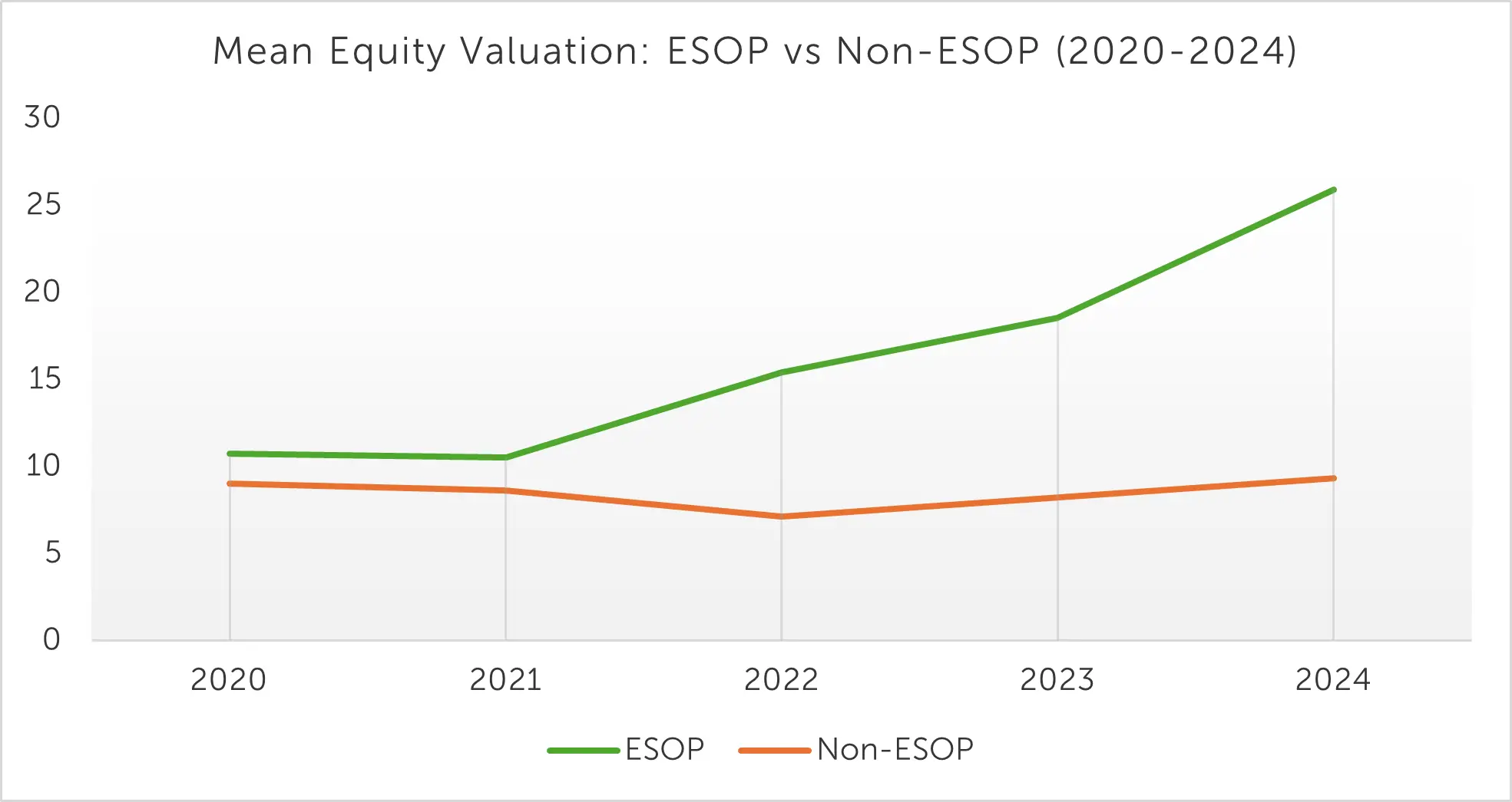

Traditionally, ESOPs have been viewed as mechanisms for employee retention and succession planning. While these benefits remain valid, modern ESOPs, especially those structured as Peak Performance Trusts (PPTs), offer far more. They fundamentally reshape the business’s internal dynamics, aligning employee incentives with company performance and creating a culture of ownership that drives measurable improvements in valuation.

As highlighted in our LinkedIn newsletter, the value creation mechanism of ESOPs operates on multiple levels. At its core, employee ownership changes behaviour. Employees become co-owners, not just workers. This shift fosters accountability, engagement, and a shared commitment to growth.

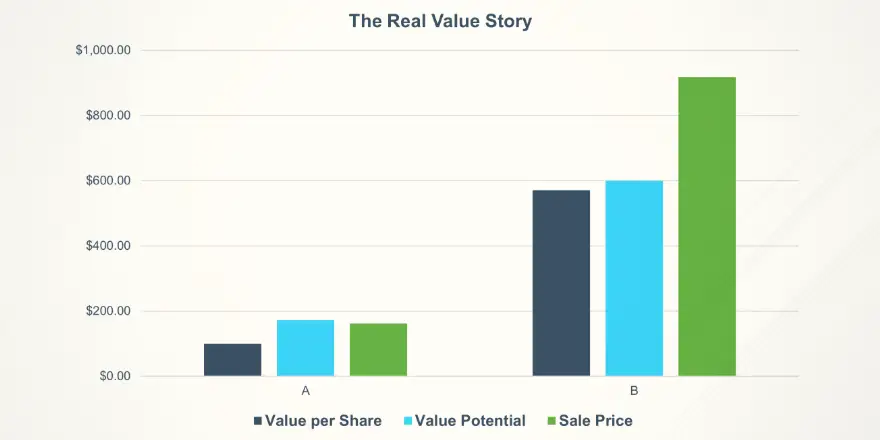

Valuation is not only about earnings but also about risk and return. According to Business Valuation Tips and Traps, valuation is calculated as:

Valuation = Net Operating Profit After Tax (NOPAT) × Earnings Multiple,

where the multiple is directly influenced by perceived risk.

ESOPs reduce this risk in several ways:

Risk is the enemy of valuation. Buyers assess risk across multiple dimensions—financial, operational, cultural, and strategic. ESOPs help mitigate these risks:

Buyers are drawn to businesses that are well-run, scalable, and resilient. An ESOP signals all three:

Aligning ESOP design with KPIs and profit benchmarks creates a direct link between performance and equity value. This alignment is not only motivational but also measurable.

In many of our recent conversations with clients, business owners shared how ESOPs helped them prepare for sale by normalising profits, tracking add backs, and creating a compelling narrative for buyers. One owner noted that after years of considering different reward mechanisms, they finally had the right team to implement an ESOP and saw immediate cultural and financial benefits.

Another example shows how a business moved forward with a PPT structure to retain key people and grow value over several years before sale to a strategic buyer at a premium. These stories illustrate how ESOPs are not just theoretical, they are practical tools with tangible outcomes.

In 2025 alone, five of our clients have either sold completely, merged with another business (in one case two of our Employee Share Ownership Plan (ESOP) clients merged together) or raised PE investment to fund further growth.

Beyond operational and cultural benefits, ESOPs offer significant financial advantages:

Implementing an ESOP before a sale requires careful planning - timing is critical. Owners should finalise the Employee Share Ownership Plan (ESOP) structure and design before informing staff to avoid confusion and ensure clarity . A well-prepared slide deck and introductory session can help communicate the plan effectively and the research clearly shows that education is critical to success.

An ESOP is more than a financial instrument—it’s a strategic lever. For business owners preparing to sell, it offers a triple win:

As the market increasingly rewards businesses with strong cultures, stable teams, and transparent governance, ESOPs stand out as a smart, future-focused strategy. For owners looking to exit with confidence and legacy, there’s never been a better time to explore employee ownership.

Dr Craig West

-Jan-12-2026-01-36-34-4947-AM.png) 1 min read

1 min read

Jan 12, 2026 | Business Value Acceleration

Unlock Your Business’s True Value Potential

3 min read

3 min read

Dec 4, 2025 | Resources Succession Planning Business Value Acceleration

Corporate Governance for Stronger Succession and Exit Outcomes

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

3 min read

3 min read

Oct 8, 2025 | Business Value Acceleration

Preparation Drives Premium | Strategy to Sale Results